Democratic senators urged the Consumer Financial Protection Bureau this week to be vigilant in monitoring buy now, pay later offerings, especially during the holidays, so it can curb tools that “prey upon consumers.”

Sen. Sherrod Brown, who is the chairman of the Senate Committee on Banking, Housing and Urban Affairs, along with Sens. Raphael Warnock of Georgia and John Fetterman of Pennsylvania made the plea in a letter Monday to CFPB Director Rohit Chopra.

“We urge you to continue focusing on this increasingly popular form of consumer credit and use the full range of your authority to ensure that it is not used to prey upon consumers,” the Monday letter said.

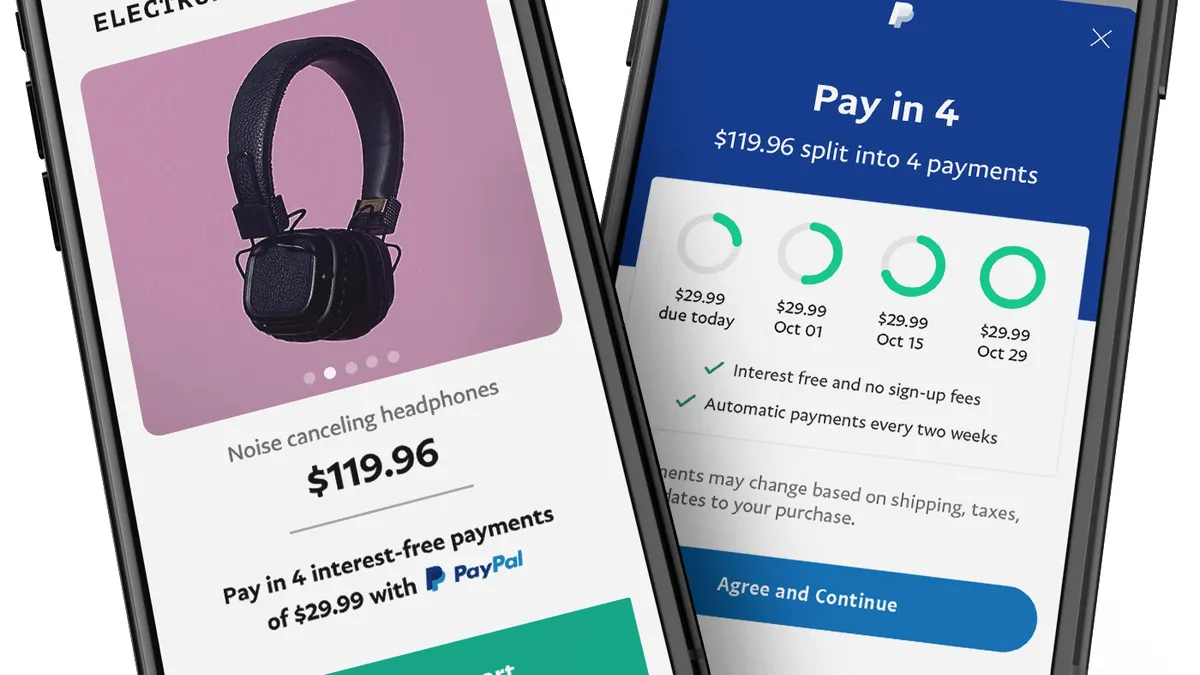

The letter followed a Banking committee CFPB oversight hearing last month in which Chopra said he would closely watch the increasingly popular payments tool. When consumers tap one of the many BNPL offerings available, they’re able to take possession of a good or use a service with only a down payment and a promise to pay the rest of the price over a period of time, sometimes interest-free and usually over four to six weeks.

The installment payment method has increased in availability in the U.S. over the past five years, with a surge of interest during the COVID-19 pandemic when many online shoppers first encountered the option. The payment method, offered by companies that include Klarna, Affirm, PayPal and Afterpay, was initially mainly available digitally, but is now increasingly offered in stores as well.

While BNPL has proven helpful to some consumers seeking to avoid interest payments and credit history hurdles, it has also shown signs of potentially encouraging risky debt profiles.

The CFPB has collected information on the new payment BNPL phenomenon and its purveyors, suggesting it may seek to further regulate the nascent industry. Nonetheless, it has yet to issue any particular guidance or guardrails directed specifically at BNPL providers. Nonetheless, some companies are bracing for increased scrutiny by the agency.

The senators said they were writing their letter now in light of the year-end holiday shopping season, when some consumers load up on debt to pay for gifts. They noted that BNPL is typically used for online purchases ranging from $50 to $1,000.

“BNPL may be structured to encourage consumers to purchase more and take on more debt,” said the letter, which was noted in a press release from the senators. “Unfortunately, consumers can overextend their finances in a short period of time, making the BNPL debt unmanageable.”

They noted that consumer use of BNPL payment options soared during the Black Friday and Cyber Monday shopping period, with $8.3 billion spent online using those tools, a 17% jump over last year, according to the letter.

“The increased use of BNPL and the debt burden being carried by the typical holiday BNPL customer make it all the more important that consumers are protected during the holiday season, whether they finance their holiday shopping using a credit card or BNPL loan,” the letter said.

The letter also pointed out that BNPL is often used by some of the most financially vulnerable U.S. consumers, including those who have low incomes, significant debt and low credit scores.

“The CFPB must ensure that BNPL does not become a method to take advantage of struggling consumers,” the letter concluded.