Dive Brief:

- The Clearing House has invested $320 million in creating a U.S. real-time payments network, and now it wants businesses to step up and invest in their own technology to use the system. To persuade businesses of the network's billing promise, the CEOs of 23 big banks that own The Clearing House issued a letter May 5, underscoring their commitment to completing the project.

- The real-time system currently reaches about 60% of customer accounts, and The Clearing House expects that percentage to rise to about 90% by the end of this year, as payments processor Fiserv finishes integrating into the system, said Russ Waterhouse, The Clearing House's executive vice president of product development and strategy.

- The Clearing House seeks to draw more business billers into the real-time network, where they will be able to present a request for payment through bank channels to consumers online or via phones. The goal is to have 40% of consumer accounts digitally enabled in the system this year, reaching a "critical mass" mark, Waterhouse said.

Dive Insight:

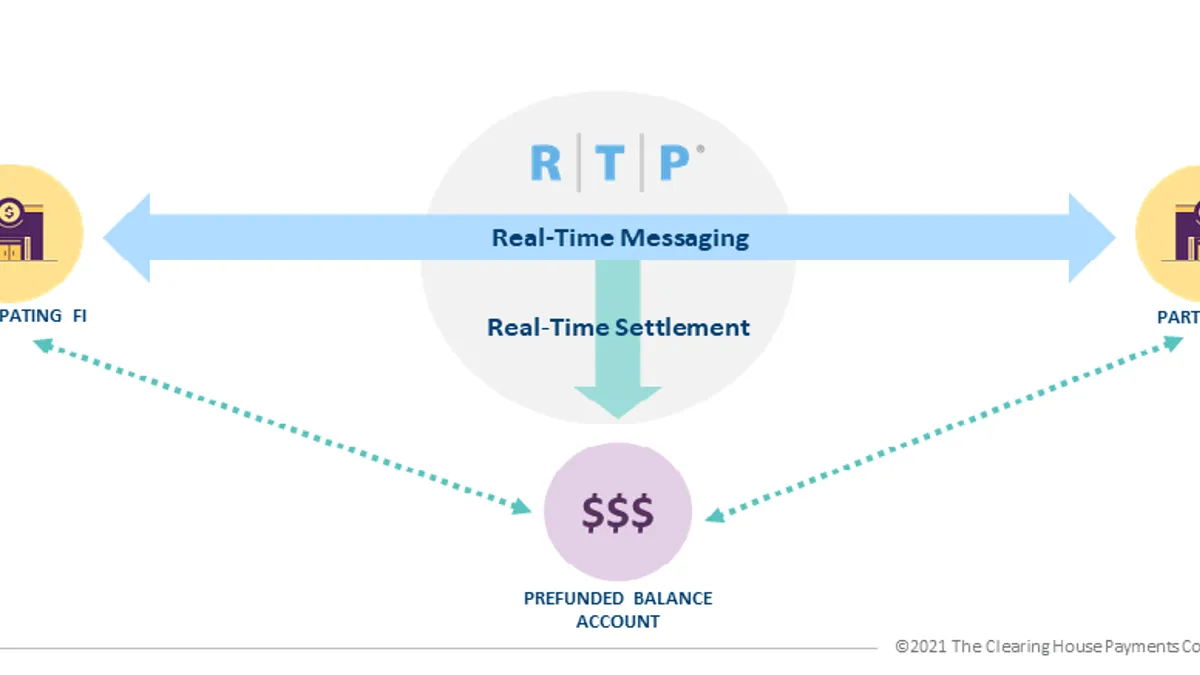

The Clearing House, the New York based, bank-owned operator of one of only two U.S. payments systems, has been building out the real-time payments system since 2017. The only other operator of a U.S. payments system, the Federal Reserve Board, is also seeking to build a competing real-time payments system called the FedNow Service, but that's not expected to launch until 2023.

The May 5 letter from the CEOs of the 23 banks that own The Clearing House, plus two at major payments processors, was directed at business billers, Waterhouse said. "The statement to billers is: 'We've made the investment, and we're going to continue to invest, so you can get to all accounts and that should give you confidence that you can invest with us," Waterhouse said in an interview with Payments Dive.

"They have to believe this is a game-changer," Waterhouse said of the buy-in sought from the billers. The banks are already there. They've individually invested tens of millions of dollars, probably for a collective $2 billion or so, estimates Waterhouse. "They absolutely believe in it," he said of the banks.

The banks are currently discussing how much more to invest, but Waterhouse didn't have any specific information on that point. "They're fully committed to finish this game — they recognize it's a journey, but it's one they're committed to," he said.

Use cases for the new service include: employers paying workers real-time at the end of every shift; insurance companies expediting a claims payment to a customer; or merchants getting faster payment settlement to buttress cash flow.

Joining a real-time payment network isn't something that The Clearing House or the Fed can mandate so they're in the position of persuading businesses to adopt what is promised to be a faster, safer, more cost-effective means of billing clients. "We're just at the start of the awareness campaign," Waterhouse said of the Clearing House effort.

Here's how The Clearing House made its pitch in the letter: "Now, enabled by the RTP network, we are committing to deliver the next revolution in how we present and pay bills through a smarter, safer, and more transparent digital experience."

As it seeks to draw companies to its real-time system, The Clearing House is competing against those billers already using their own digital systems to draw payments from consumers. It's also up against Apple Pay and Google Pay options using credit cards. But those alternatives aren't real-time systems, and The Clearing House contends the billers would benefit — as would their customers — from faster, more efficient real-time payments.

The U.S. has been behind other countries, including India and the United Kingdom, in developing a real-time payments system. Now, a host of new technologies and startups in the payments ecosystem are egging on U.S. development of a real-time system.

Signers of the letter included the CEOs of Bank of America, Citigroup, JPMorgan Chase, KeyCorp, PNC Financial Services, and Truist Financial, among others. In addition, the CEOs of payments processors Fiserv and Jack Henry & Associates joined in.

One major processor that didn't sign the letter was Fidelity National Information Services, better known as FIS. FIS was invited to sign the letter, but didn't, said Waterhouse, deferring to FIS for an explanation. FIS spokesman Adam Kiefaber declined to comment on why his company didn't sign the letter.

FIS has recently been pitching its own new real-time service called RealNet, which it says will help customers find "the fastest, most cost-efficient payments option for a given transaction in real-time," though that may not mean the payment itself is sent in real-time. The new FIS service may use The Clearing House's real-time network to send payments, among other possibilities.

"All the movement around real-time payments is going to be the future," FIS Senior Vice President Virginia Chappell said in a recent interview. "It didn't have the ubiquitous reach until just recently."