Dive Brief:

- Clair, a fintech that enables employers to pay hourly and gig workers when the employees want, has recently raised $15 million in additional capital, bringing its total funding to $19.5 million, the company said in a press release Thursday.

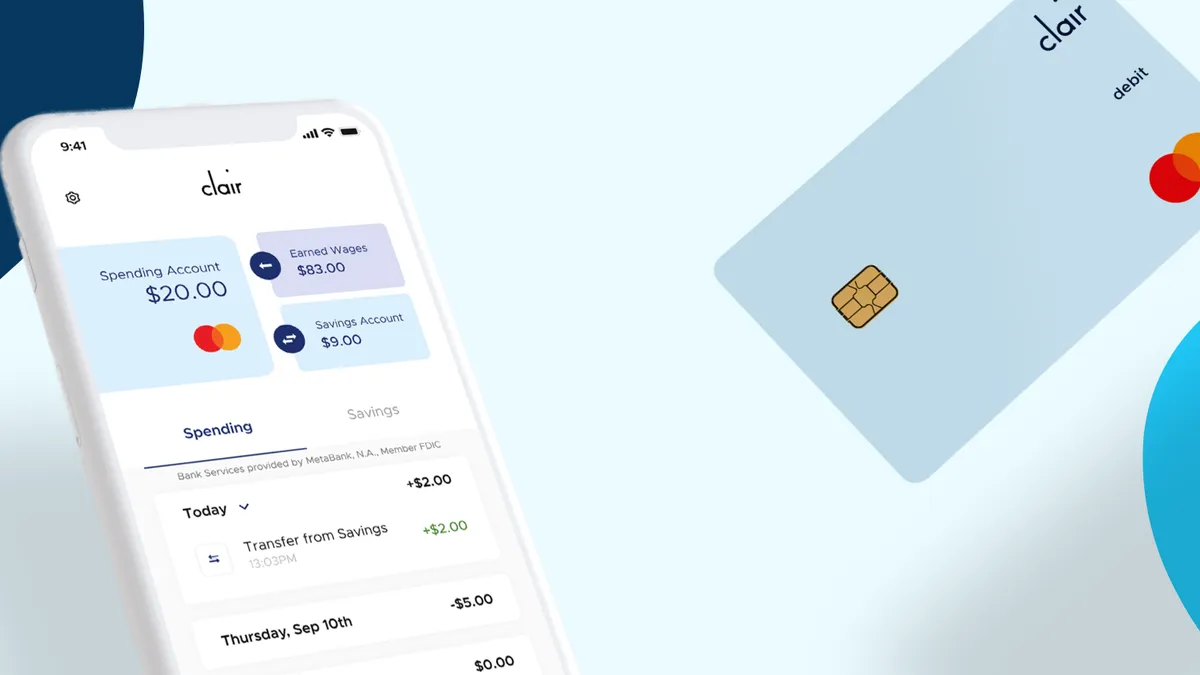

- The New York-based company, which was founded in 2019, partners with human resources tech companies and gig work companies to give workers free access to their earnings before their usual payday. Neither employers not employees pay for the service. Rather, Clair earns revenue under a partnership with Mastercard via a Clair debit card when employees use it to buy goods and services.

- Clair will use the new venture capital to expand its operations, as employers increasingly embrace the on-demand pay trend and competition to provide employers with such services intensifies.

Dive Insight:

Clair is part of a clutch of companies seeking to offer employers some form of service that lets employees access earned wages in advance of a typical pay schedule. It promises hourly workers "free instant cash advances on their earnings," according to the press release.

Clair partners with gig-economy companies, which tend to have large workforces of employees working independently, and human resource technology companies and offers the services through them to employees. So far, Clair's partners include Bravocare, a company that arranges shifts for skilled nursing staff, and Attendance on Demand, a cloud-based workforce management company.

Overall, Clair's services are available to about 1.5 million workers, with about one million accessing the services through Attendance on Demand, according to a February press release on that partnership.

Clair's partners provide employees with MasterCard debit cards and then earned wages that the employee wants access to flow to the card. Clair takes a cut of the interchange fee on card purchases. Claire announced its relationship with MasterCard in February, and then said in May that MetaBank would act as the card issuer, with Galileo as a processor.

Employee demand for on-demand pay services appears to be a growing global trend as documented last year in a survey of 4,000 working adults worldwide (albeit with a focus on the U.S. and U.K.) by consulting firm EY. An EY report on the survey said 80 percent of respondents would use such a service. "The main use case for On-Demand Pay is that of everyday financial pressures, which we have found to be widespread," the report said.

Employers are also beginning to recognize that offering the service could be a potential competitive edge in their efforts to lure workers, though it can come with some payroll administration and compliance considerations as employers handle taxes and deductions differently.

Rival PayActiv has grown even more than Clair. San Jose, California-based PayActiv, which was founded in 2011, said last August that it had closed on a $100 million round of funding. It's providing on-demand pay services for large payroll and human resources services companies like Paychex. A Dubai-based competitor, Flexxpay, has been raising money as well.

Both Clair and PayActiv are pitching their services as a means to bring workers more financial security by giving them access to money for bills or emergencies and saving them from expensive overdraft fees or payday loans.

"We're on a mission to give workers easier, faster access to their hard-earned cash," Clair CEO Nico Simko said in the release. "We want to promote financial inclusivity for everyone, and we are doing this by enabling existing HR tech providers through innovative fintech tools."

Before co-founding Clair, Simko was an investment banker at Wall Street giant JPMorgan Chase, working with fintechs in the payments industry, according to Clair's web site. He has a bachelor's degree in economics from Harvard University.

Thrive Capital was the lead investor for the recent $15 million fundraising. Last year, Clair raised $4.5 million in a round led by Upfront Ventures and with participation from former Venmo Chief Operating Officer Michael Vaughan.

Correction: The story was updated to correct the year that Clair was founded.