The Consumer Financial Protection Bureau (CFPB) is leaving the sandbox and recasting its innovation efforts to emphasize its role in promoting competition.

The agency’s newly established Office of Competition and Innovation, announced Tuesday, aims to explore how customers can more easily switch accounts and financial providers. The office also will hold “incubation events” such as open houses, sprints, hackathons, tabletop exercises and war games to help entrepreneurs and tech specialists troubleshoot barriers to innovation and share their frustrations with regulators, the bureau said Tuesday. Results of those events would be shared publicly, the agency said.

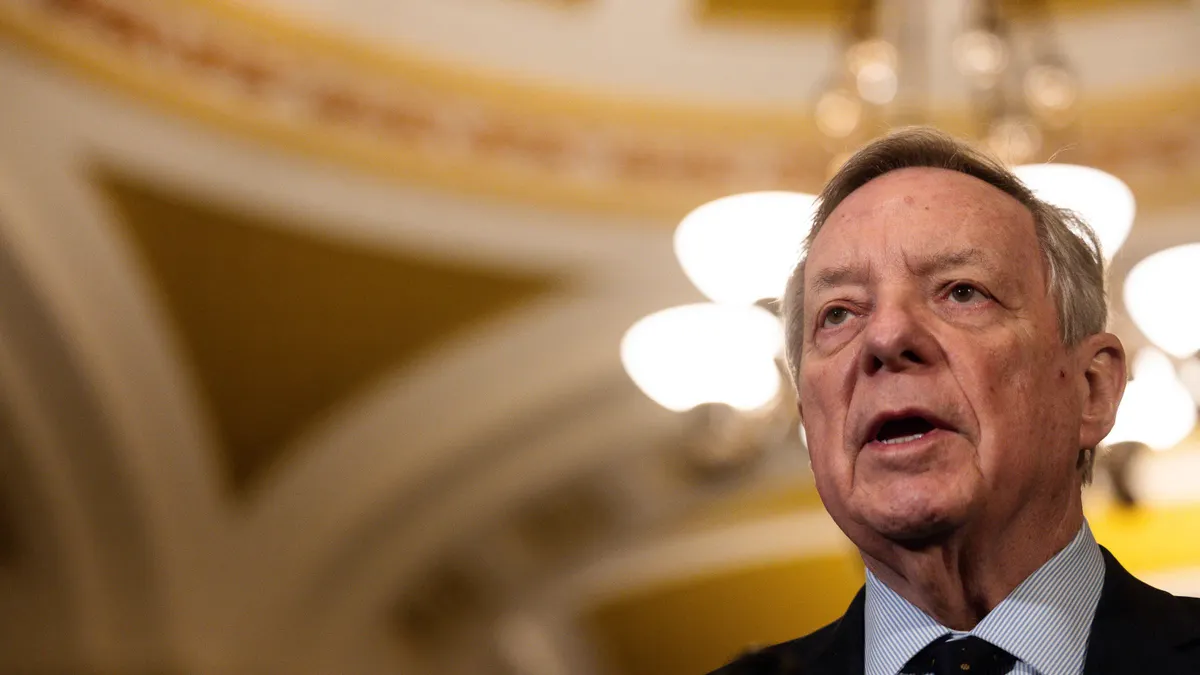

“We will be looking at ways to clear obstacles and pave the path to help people have more options and more easily make choices that are best for their needs,” CFPB Director Rohit Chopra said in a press release.

The new office will replace the Trump-era Office of Innovation, which let individual companies apply for no-action letters to develop specific products under a safe harbor it labeled a sandbox.

The no-action letter policy dated back further — to Project Catalyst, which launched in 2014 under the Obama administration. Participation, however, was sparse.

The CFPB in 2020 gave Synchrony Financial a three-year safe harbor from liability under the Truth in Lending Act and Regulation Z to develop a credit card for consumers with a limited or damaged credit history. On the same day, the bureau granted the fintech PayActiv similar protections over two years for an early wage access product.

Alternative lender Upstart received the agency's first no-action letter in 2017 to develop its automated underwriting model, then renewed it in 2020, after the initial term expired. Bank of America received a no-action letter in November 2020 to shield its Balance Assist small-dollar loan product during development. And JPMorgan Chase received a no-action letter in September 2020 over a mortgage lending initiative.

The no-action letter and sandbox system "proved to be ineffective," the CFPB said, adding that some companies "made public statements indicating that the Bureau had conferred benefits upon them that [it] expressly did not."

The new office, meanwhile, is geared toward ensuring big firms like JPMorgan or BofA don't "stifle competition by exploiting their network effects or market power," the CFPB said Tuesday, adding it aims to use competition, particularly from startups, to "pressure ... incumbents to maintain high levels of service."

“Competition is one of the best forms of motivation," Chopra said. "It can help companies innovate and make their products better, and their customers happier."

Reach isn't the only barrier for startups, though. To that end, the CFPB said it intends, through the new office, to address instances when smaller companies lack access to capital, talent or data — the latter of which may be stored by big banks. The CFPB signaled Tuesday a future rulemaking would give consumers access to their own data.

The bureau is placing the new office within its research, markets and regulation division to allow it a deeper look at aspects of market structure that may prove an obstacle to innovation, it said.

Tuesday's move continues a trend wherein regulators cannibalize efforts launched by previous administrations. The CFPB in June 2021 resumed examining lenders for potential violations of the Military Lending Act — a reversal from a Trump-era stance. The Office of the Comptroller of the Currency (OCC), six months later, rescinded a Trump-era rewrite of the Community Reinvestment Act (CRA). The OCC, Federal Reserve and Federal Deposit Insurance Corp. (FDIC) have since issued a joint proposal on how to refresh the 1977 rule.

But not every analyst sees the trend as a positive.

“The problem here is that each successive CFPB administration razes what came before and starts building anew rather than using any of the foundation laid by the prior administrations,” Eric Mogilnicki, chair of Covington & Burling’s consumer financial services practice, told American Banker. “That approach causes whiplash for the regulated and throws out perfectly good ideas simply because they were proposed by a prior director.”