With a pandemic keeping customers homebound, brand-name businesses and retailers are putting their energies into rewards that are more tangible than points. For many, this means cash back bonuses based on transaction activity.

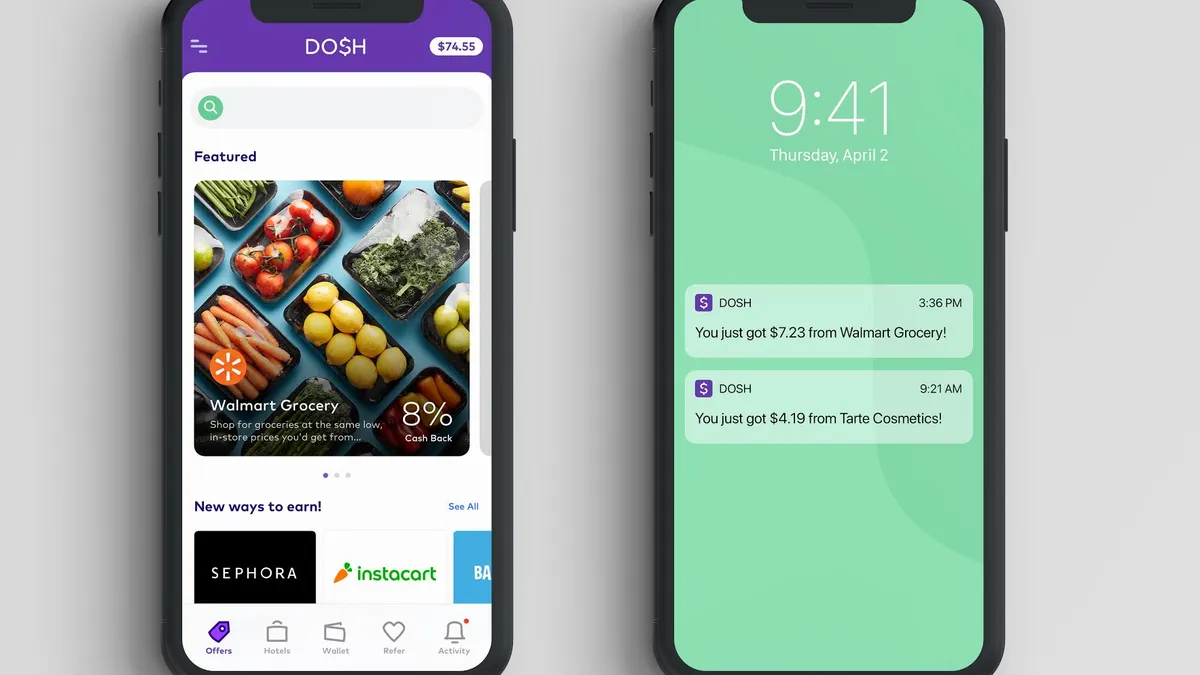

The technology that supports cash back offers is spurring a hotly contested space. Last week, Cardlytics, a publicly-traded company whose toolset helps banks deliver cash back rewards, acquired 5-year-old Austin-based fintech Dosh for $275 million in cash and stock. Dosh supports cash rewards for financial services companies Betterment and Ellevest, as well as PayPal's fintech Venmo, N26 and others. It also offers a stand-alone cash back app directly to consumers.

The acquisition will allow Atlanta-based Cardlytics to expand beyond users who bank with JPMorgan Chase, Wells Fargo, PNC and others, to younger users who may prefer to use nonbank financial apps. For now, Dosh and Cardlytics will operate as separate entities.

"Dosh expands Cardlytics' user base across millennials and younger consumers, particularly through Dosh's partnerships with Venmo and several neobanks. It also provides access to smaller retailers," Lynne Laube, co-founder and CEO of Cardlytics, told Payments Dive.

By acquiring Dosh, Cardlytics gains a speed-to-market advantage by way of an easily deployed technology that can be launched in weeks instead of months. In addition, the Dosh direct-to-consumer app helps the company get a better understanding of consumer purchase habits.

"Their direct-to-consumer app allows us to quickly understand what drives consumer engagement so we can further increase advertiser returns and rapidly launch scaled deployments with our financial institution partners," Laube said.

Dosh CEO and Founder Ryan Wuerch wouldn't comment on how many users his platform has, but said Cardlytics reaches around 163 million monthly active users.

"This is really positioning the collective companies to have the most comprehensive and the largest purchase transaction advertising platform in the industry," Wuerch said.

Dosh's non-financial brand partners include Walmart, Pizza Hut, Dunkin' Donuts and Sephora. The rewards, which are funded by merchants, operate as an advertising tool to help brands draw in customers and keep them loyal.

Growing engagement

For fintechs, cash back rewards are a growing engagement driver that allows them to enable offers most relevant to their customer bases. Katherine Kornas, Betterment's vice president of product, said in a recent interview cash back rewards can contribute to its clients' bigger financial health goals.

Dosh's software development kit and application programming interfaces-based approach allows financial brands to onboard cash back rewards programs with ease and personalize offerings for customers. Brands can also choose from curated reward buckets Wuerch calls collections. Digital banking and investing app Ellevest used this tool, which launched this week, for its cash back rewards program aimed at women-owned businesses.

"That's a module that they can actually [enable], and all this is built on user research, so all these neobanks and financial services companies are getting the benefit of all of our resources and behavioral studies that they don't have to build it for themselves internally," Wuerch said.

On Tuesday, neobank N26 rolled out a curated cash back offering for U.S. customers supported by Dosh, with rewards from retailers Walmart and L'Occitane as well as shoemakers Adidas and Converse and Marathon Petroleum. Alex Weber, chief growth officer of N26, suggested the move was an effort to tie the banking brand to lifestyle brands that resonate with customers.

"The goal of our Perks program has always been to help customers save when spending with their debit card on brands they love," Weber said in a statement.

Laube and Wuerch highlighted that in building personalized offerings, the companies don't receive personally identifiable information from the customers' accounts.

Future growth, future cash back

Other avenues for growth for Dosh and Cardlytics include scaling the rewards platform to new geographies, including in the U.K., where Cardlytics already has a presence.

Alongside Dosh, the cash back rewards field has gotten crowded in recent years, with Google Pay enhancing its card-linked cash back offerings in recent months ahead of its Plex bank account launch, and the growth of cash back platforms like Rakuten and Ibotta. Merchants now have considerable choice when deciding to launch a program, but Wuerch suggested Dosh and Cardlytics' strengths stem from their technical capabilities and scale.

Dosh and Cardylytics offer clients access to customer insights based on anonymized transaction data, he said.

While cash back rewards are popular among digital banking startups, some fintechs — including Stash and Bumped — offer fractional share rewards. To Wuerch, cash back is the easiest and most accessible way to receive rewards. They offer the end user the flexibility to spend the money the way they want, an important advantage in troubled economic times, he said.

"No one really knows what points mean — how does that really translate into dollars? But everyone understands what a dollar means, or ten dollars means — You're empowering the consumer to be able to go use those dollars however they want to use them," Wuerch said.