Jeff Tassey is chairman of the board of the Electronic Payments Coalition.

Recent efforts by big-box retailers to undermine debit and credit card rewards programs are disastrous for consumers and merchants alike. This fact is intuitive enough—after all, everyone loves their rewards. But more than that, the value of rewards is supported by substantial empirical research, as the Electronic Payments Coalition’s (EPC) recently-released study clearly illustrates.

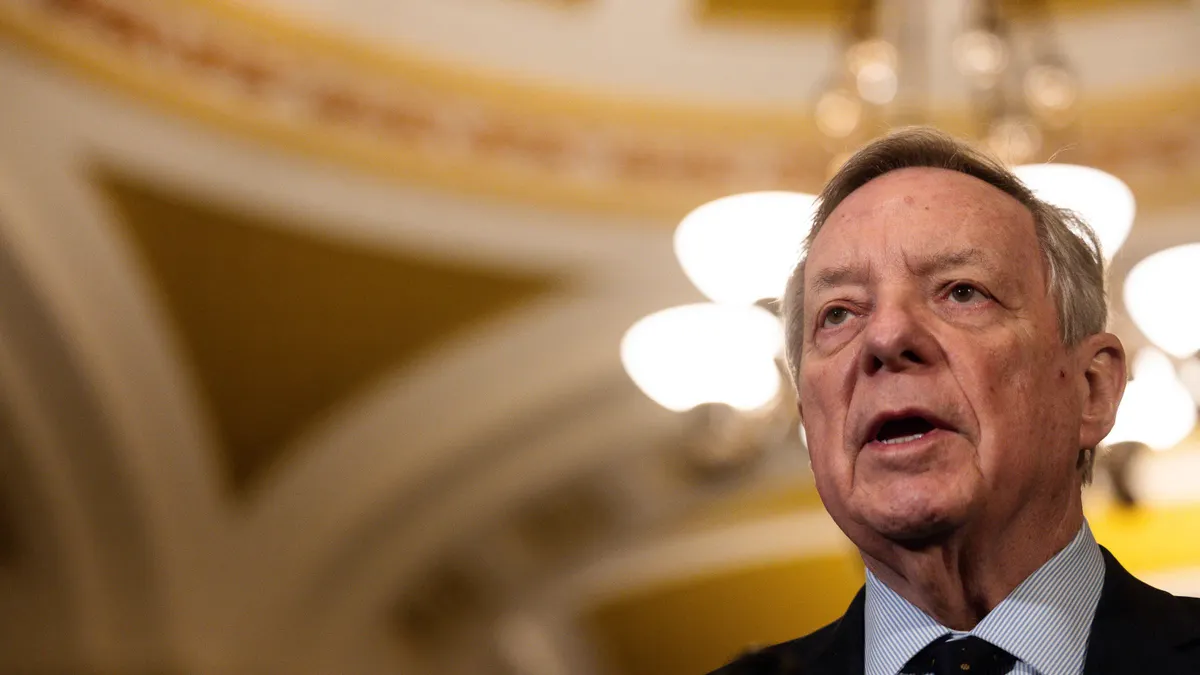

However, this reality hasn’t stopped retail advocacy groups from attempting to tear down the very rewards programs that so many enjoy. These well-funded groups are seeking to expand the 2010 Durbin Amendment, overhauling credit routing regulations and capping interchange fees. Doing so would eliminate the vital investments funding debit and credit card rewards programs and serve as a massive wealth transfer—putting more money in the pockets of Amazon and Walmart.

Their latest tactic: spreading a factually vacuous myth known as “Reverse Robin Hood.”

Perpetuated by mega-retailers and their allies, this bogus idea asserts that low-income cardholders subsidize rewards programs for the benefit of the wealthy. Essentially, they falsely claim that debit and credit card rewards rob the poor to give to the rich, establishing an unfair system.

But, unfortunately for retailers, such claims rely on weak assumptions and ignore the tremendous utility these rewards programs provide consumers of all income levels. As one recent report accurately summarized, “the reverse Robin Hood may be more mythical than the original Robin Hood.”

The biggest blow to the “Reverse Robin Hood” myth is the fact that card issuers bring in more revenue from high-income cardholders. According to data from Phoenix Marketing International, credit cardholders with higher incomes pay significantly more in fees and interest than those with lower incomes.

Cardholders with higher incomes also deliver more value to card issuers than those with lower incomes in the form of interest payments and annual fees, and their higher purchase volumes generate more interchange revenue. Indeed, higher-income cardholders generate almost three times more value for card issuers than lower-income cardholders.

Proponents of the “Reverse Robin Hood” myth principally assume that card issuers impose exorbitant costs and fees on low-income cardholders. This is not true.

According to an EPC analysis of Verisk Financial data, the relationship between income and credit scores is quite weak. As such, lower-income cardholders do not face higher interest rates than their upper-income counterparts — in fact, the average annual percentage rate charged to the lowest-income cardholders is nearly identical to that of the highest-income cardholders. Consequently, low-income cardholders do not bear unequal cost burdens as a result of these programs.

But the falsehoods don’t end there. Adherents to the “Reverse Robin Hood” myth also argue that merchants pass through the costs of card acceptance to customers, resulting in higher prices on all consumers (including lower-income consumers who are more likely to pay with cash or debit) in order to pay for rewards cards.

However, there is little evidence supporting the existence of this pass-through because merchants gain far more from accepting rewards cards than they pay in interchange and other fees. Specifically, after accounting for savings from the cost of cash, incremental transaction increases from ticket lift, and other benefits, merchants that accept credit cards gain more than 9% in transaction value—far exceeding the 2% to 3% they typically pay in swipe fees.

One of the key ways that merchants benefit from accepting credit cards is via the “ticket lift” effect in which customers who pay with debit or credit cards spend more than those who pay with cash. This effect is even more pronounced among reward card users.

The coalition's Value of Rewards study finds that rewards credit cards are associated with an average transaction size 25% to 60% higher than non-rewards credit cards. As such, the rewards card ecosystem accelerates economic activity, and a rising tide lifts all boats. In reality, merchants and retailers stand to lose a great deal if these programs are eliminated.

Most importantly, Americans— regardless of income—love their credit card rewards programs. The study found that 95% of consumers earning less than $20,000 per year have access to a credit or debit card. Of these, 82% of cardholders own at least one rewards card. Moreover, 97% of total credit card spending is charged to rewards accounts, and almost three-fourths of rewards cardholders redeemed their benefits within the past year.

The popularity of rewards cards is only growing stronger as well—56% of cardholders reported that their rewards card became even more important to them during the COVID-19 pandemic. There’s no question about it: rewards cards are a ubiquitous feature of American commerce, and consumers from all backgrounds place tremendous value on their benefits.

The “Reverse Robin Hood” myth claims low-income cardholders bear the costs of credit card rewards programs without receiving any of the benefits. While it’s an effective misinformation tactic, the claim is untrue. The reality is that rewards programs are both popular and incredibly helpful to consumers and merchants alike, and for good reason.

For consumers, debit and credit cards provide convenience and security, and rewards-based cards offer an additional perk. For merchants, accepting debit and credit cards provides more sales revenue, and the value these cards generate for their bottom line far exceeds the interchange fees they pay. Enacting policies to reduce or eliminate rewards programs is a fools’ errand.