Dive Brief:

-

The use of buy now-pay later (BNPL) payment options has been skyrocketing over the past year with over 60% of customers in the U.S. using BNPL financing for an online purchase over the past 12 months, according to a recent report from the market research firm C+R Research.

-

The study found that two in three online shoppers believe BNPL financing is "financially risky," while 59% say they've purchased an "unnecessary" item they otherwise couldn't afford, using buy now-pay later. Payments made through the BNPL payment option are expected to swell to $995 billion by 2026, compared to $226 billion, according to a separate recent Juniper research report.

-

“There could be a number of factors behind this sentiment, but one major risk revealed by the study is the default in payments,” Collin Czarnecki, content strategist and researcher at C+R research said in an email. “The average item purchased with BNPL costs $689, a sizable sum of money to pay back over time. It may come as no surprise that 57% regret financing a purchase with BNPL because it was 'too expensive,' 56% admit to falling behind on making payments.”

Dive Brief:

While 56% of the U.S. customers prefer financing options offered by programs like Affirm, PayPal Credit, and Afterpay to traditional credit cards, 57% still say they "regret" financing a purchase through BNPL because it was too expensive, according to a recent study.

As customers get more accustomed to online shopping and payments with 67% happening online last year amid the COVID-19 pandemic, the BNPL payment option is gaining popularity. Despite increasing usage of BNPL, 66% of consumers believe it's financially risky to use the BNPL payment option, the study stated.

“Many resorted to online purchases out of necessity during quarantine, and others leaned into the ease of use,” Czarnecki said. “C+R Research’s latest study indicates that consumer sentiment around payment methods for those online purchases may be shifting.”

In the U.S., 71% of customers have been purchasing more goods online since the start of the pandemic, according to the research. As per the survey, 60% of consumers have used the BNPL payment option in the past 12 months while 46% are currently making payments for a BNPL financing.

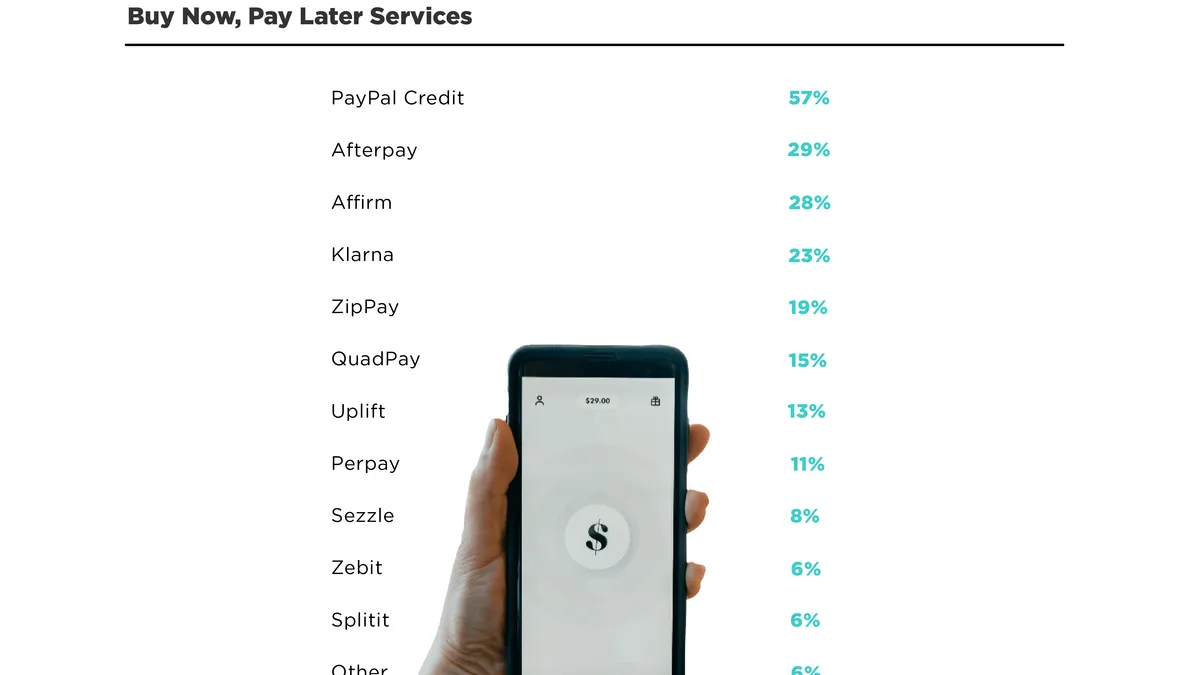

Clothing (47%), electronics (44%) and furniture (32%) were the most common purchases made through the BNPL payment option. PayPal Credit (59%), Afterpay (29%), Affirm (28%) and Klarna (23%) were the top consumer choices for a BNPL payment provider over the last 12 months, the study stated.

The BNPL payment option is preferred over credit cards among many customers for various reasons, the study said. Roughly half of respondents (56%) said they prefer BNPL over credit cards, while an additional 25% say they prefer BNPL over credit cards sometimes, according to the study.

“Financing large purchases, and even mid-size purchases, in small increments can seem incredibly appealing for those who are over-extended on credit,” Czarnecki said. “While many are choosing BNPL over credit cards for the flexibility and low interest rates, it’s possible that BNPL has become a last resort option for those with low and maxed out credit card limits.”

Easier to make payments (45%), more flexibility (44%), low interest rates (36%) and easy approval (33%) are some of the top reasons for consumers pivoting to BNPL over credit cards. While the adoption of BNPL among consumers is increasing, those seeing it as "financially risky" is a barrier to mass adoption.

Regulatory hurdles might also slow down acceptance of BNPL payment options but demand for such payment methods will likely continue to grow, according to the Juniper research.

In the U.K., the Financial Conduct Authority announced earlier this year that it plans to tighten regulations on BNPL payments. The FCA argues that BNPL payment options urge consumers to spend more than they can afford to pay.

“Changes are urgently needed to bring BNPL into regulation to protect consumers,” Christopher Woolard, chair of the review at the FCA said in the press release. “To ensure that there is secure provision of debt advice to help all those who may need it. So, it’s vital that we have a fair market that works for everyone.”

Some reports suggest similar regulatory steps are expected in the U.S. by the Consumer Finance Protection Bureau as the payments adoption rate increases and BNPL companies spill into professional services.

C+R Research surveyed 2,005 U.S. customers between March 25 and April 21 with an average age of 37 among the surveyed base.

“It’s hard to predict the future, but 38% of those we surveyed said they say BNPL options will eventually replace their credit cards all together,” Czarnecki said.