Buy now-pay later use in the U.S. climbed to an all-time high during the 2021 holiday season, but its novelty may have begun to wear thin.

According to a Jan. 12 Bank of America analyst report, total U.S. buy now-pay later (BNPL) app downloads for the top operators Affirm, Afterpay, Klarna and Zip (formerly Quadpay) rose to 3.47 million in December.

Though the December figure shows a 20% year-over-year (YOY) increase, which was higher than the 14% YOY rate for November, the rate of increase is slowing compared with a more than doubling (131% increase) between January and June last year, according to the note.

Sweden-based Klarna, which formed a strategic alliance with Stripe last year, was the only BNPL provider that showed a "clear acceleration" in the U.S. market in December, compared to November, both in terms of app downloads and monthly active users, the note said. Klarna’s app downloads grew 37% in December YOY, compared with a 3% YOY increase in November.

Klarna launched its services in the U.S. in 2015, and grew last year with the introduction of more services, including the ability of consumers to pay in full. The BNPL trend got its start largely outside the U.S., but in recent years all of the players have flocked to the big U.S. consumer market.

Meanwhile, Afterpay and Zip "saw slower growth in December" versus in November and the first half of the year, while Affirm’s December metrics were stable, indicating that it is gaining market share along with KIarna, the report said. BofA estimates Affirm's U.S. download growth in December at 82%, which the note calls "the highest absolute level of growth among providers." Amazon chose Affirm last year to provide its customers with BNPL services.

"Of note, December was the first month in our data set (back to 2018) that app downloads of Affirm surpassed those of Afterpay, which could be driven in part by Affirm’s newer merchant partnerships (i.e. Shopify and Amazon)," according to BofA.

In December, total U.S. monthly users of BNPL providers hit an all-time high of 8.42 million, although growth slowed to 67%, compared with 69% in November, the note said.

Nonetheless, BofA sees plenty of room for growth, since BNPL represents about 2% of global e-commerce sales and roughly 3% of U.S. online shopping. BNPL also has room to grow in Europe, Latin America and Asia. Australia and Sweden are exceptions since they are the home of Afterpay and Klarna, respectively. BofA estimates that BNPL’s market penetration in those countries is about 20% of e-commerce sales.

"Affirm and Klarna can handle a wide range of transaction sizes, while Afterpay is more focused on smaller ticket items," BofA says. "Afterpay and Klarna are heavily focused on customer acquisition, shopping experience and marketing, with Afterpay particularly strong on this front in the U.S. and Australia, and Klarna strong in Europe."

San Francisco-based digital payment tools company Square agreed to pay $29 billion last year to acquire Afterpay.

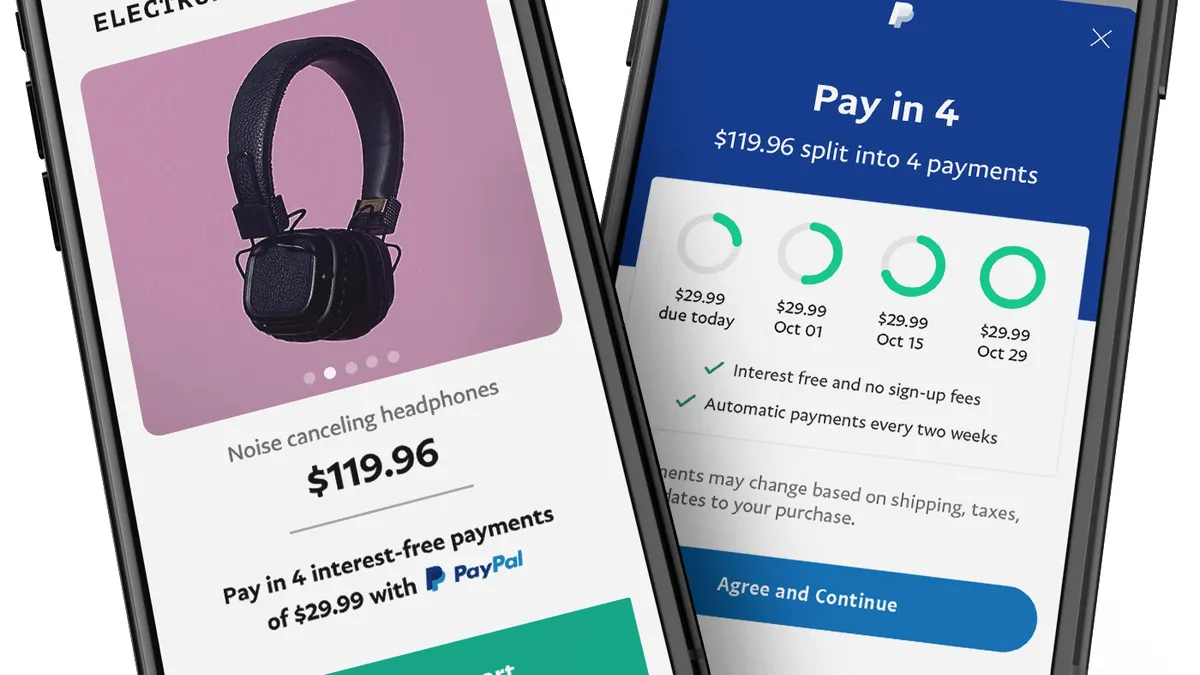

Payments giant PayPal also has a foothold in the BNPL market through its "Pay in 4" service introduced in 2020, which lets consumers spread the cost of purchases between $30 and $600 over four equal installments interest-free. Pay in 4 is the "most favorable and trusted" U.S. BNPL brand, according to Bank of America. Its report cited a survey in which 58% of respondents were familiar with the brand. PayPal plans to expand its BNPL business this year beyond the Pay in 4 service, the bank said.

In a November report from survey research firm Morning Consult regarding consumers' holiday shopping plans, 20% of adults had planned to use BNPL to purchase gifts for their friends and family.

Younger consumers are especially keen on the service. The Morning Consult survey cited by BofA found that 38% of Millennials, 24% of Gen X and 21% of Gen Z consumers planned to use BNPL. Only 8% of Baby Boomers said they would use the service.

"Interestingly, among income levels, 32% of survey respondents with ($100,000+) in annual income were planning to use BNPL, the highest (percentage) of respondents among all income categories," BofA said. "Of those with income between ($50,000) and ($99,000), 20% were likely to use BNPL, while 18% of those with less than ($50,000) in annual income said they were likely to use BNPL this holiday season."

The growth of BNPL has aroused some concerns from consumer advocates and other critics. The Consumer Financial Protection Bureau last year began an investigation into the sector's business practices.

Correction: This story has been updated to correct the year in which Klarna started services in the U.S.