Justin Grooms is the CEO of San Francisco-based Bolt, a checkout technology company that provides services to retailers in the U.S. as well as other countries. He is based in New York.

Remember when streaming was going to save us from cable? Instead of one bloated bill, we'd have the freedom to choose exactly what we wanted to watch. Fast forward to 2024, and we're paying more than ever, juggling a dozen subscriptions, and spending our evenings trying to remember which platform has the show we want to watch.

The payments industry is careening down the same path. What started as a simple choice between cash or credit has exploded into a dizzying array of options: digital wallets, buy now, pay later services, bank payments, peer-to-peer transfers, and cryptocurrency. Each promises to make our financial lives simpler. Each, individually, might even succeed. But collectively, they're creating a maze of payment options that's becoming increasingly difficult to navigate.

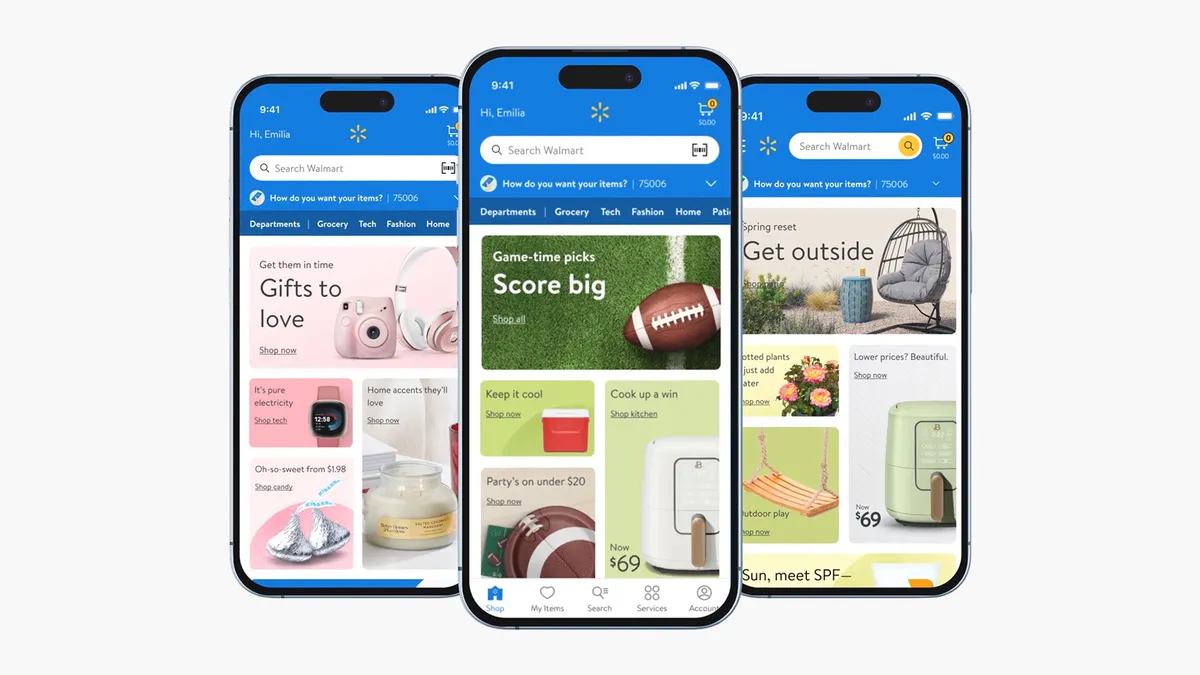

The data tells the story. Urban Outfitters recently announced that bank payments now represent about 1% of their transactions. Starbucks has been pushing customers toward direct bank account connections for reloading their cards. Walmart is developing its own wallet. Every major retailer seems to be building their own payment ecosystem, each convinced they'll be the one to break through.

But here's the thing: Consumers never asked for this complexity. They just want to pay for things reliably and efficiently. The proliferation of payment options isn't solving a consumer problem — it's solving a business problem. Retailers are desperate to escape the 3 to 4% fees charged by credit card networks, and payment startups are eager to carve out their own slice of the trillion-dollar payments pie.

The result? We're building what could best be described as "a janitor's ring of digital keys" — a different payment method for every situation. Want to split a dinner bill? That's Venmo. Buying furniture? That's a BNPL service. Getting coffee? That's a store-specific app. Shopping online? Take your pick from a NASCAR-style display of payment logos.

This fragmentation isn't sustainable. Just as the streaming wars are leading toward inevitable consolidation (witness the Paramount+ and Showtime merger), the payments industry is heading for its own moment of reckoning. The signs are already appearing. Payment companies are starting to talk about creating "networks of networks." Major retailers are exploring unified payment platforms. The Federal Reserve has launched FedNow to standardize real-time payments.

But there's a deeper story here about how industries evolve. Innovation typically follows a pattern: First comes fragmentation, as entrepreneurs rush in with new solutions. Then comes consolidation, as customers grow tired of complexity and demand simplification. We saw it with railroads in the 19th century, with radio in the 20th, and with streaming today.

What makes payments different is the scale of what's at stake. We're not just talking about entertainment or transportation — we're talking about the fundamental infrastructure of commerce. The way we pay for things shapes everything from retail strategies to financial inclusion to monetary policy.

The winners in this consolidation won't necessarily be the biggest players. They'll be the ones who understand that consumers don't want more payment options — they want better ones. They want payments that are as invisible as electricity: you flip a switch, and it just works.

This is why tech giants like Apple and Google are making inroads in payments, and why retailers are scrambling to build their own solutions. They understand that the future of payments isn't about adding more choices—it's about removing the need to choose at all.

The irony is that we might end up where we started, with a few dominant payment methods that everyone uses. The difference is that instead of physical cards issued by banks, we'll have digital payment systems that are smarter, faster, and more secure. The complexity will still exist, but it will be hidden behind the scenes, where it belongs.

For now, though, we're stuck in the messy middle. Retailers are building wallets nobody asked for, startups are inventing new ways to pay for things, and consumers are left juggling an ever-growing collection of payment apps and passwords.

But if history is any guide, this too shall pass. The great payment consolidation is coming. The only question is who will lead it — and whether they'll learn from the lessons of other industries that complexity is not a feature, but a bug.

The companies that figure this out first — that realize the goal isn't to add another payment option but to make payments disappear entirely — will be the ones that thrive in the next era of commerce. Everyone else will be left holding a ring of digital keys to doors that nobody wants to open.