With its acquisition of cryptocurrency payments company Wyre, online checkout startup Bolt plans to add crypto and web3 capabilities to its existing digital wallet in a bid to jumpstart consumers using crypto for purchases.

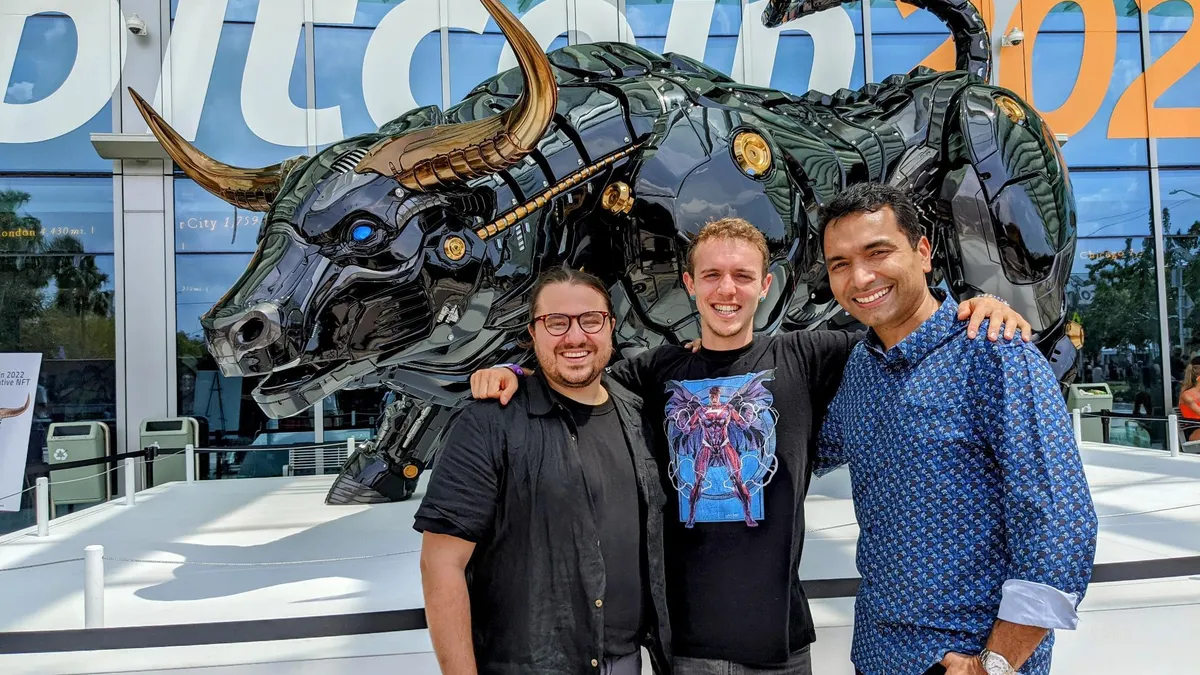

Bolt and Wyre, both based in San Francisco, announced the acquisition Thursday and Bolt CEO Maju Kuruvilla said in an interview that his company is paying about $1.5 billion in a mix of cash and stock.

Wyre is Bolt's largest acquisition yet, and that’s a reflection of the value that Wyre brings to the table, Kuruvilla said. "We believe crypto will be a major part of Bolt’s strategy going forward," Kuruvilla said in an interview. Bolt acquired Swedish embedded commerce firm Tipser last year; TechCrunch reported the all-stock acquisition was just under $200 million.

Wyre, which has primarily worked with Bitcoin, crypto exchanges and NFT marketplaces, provides APIs and infrastructure for merchants or developers to quickly build crypto businesses, said Wyre cofounder and CEO Yanni Giannaros. It also has a fiat-to-crypto gateway, a checkout product that enables merchants to accept credit card payments and convert to crypto instantly.

With Wyre's APIs, Bolt also is adding crypto capabilities to its digital wallet, allowing shoppers to store their crypto and NFT assets, Kuruvilla said. He said the crypto addition to Bolt's digital wallet will arrive this year, but couldn't be more specific.

Consumers have been slow to turn to cryptocurrencies as a means of payment, but Bolt aims to change that behavior. Kuruvilla believes combining Bolt's and Wyre's capabilities simplifies crypto's use in payments, "and we believe that that simplification is what's going to bring crypto mainstream," he said.

Talks started last year

The two companies signed the agreement Wednesday and the transaction is expected to close later this year. Wyre, which had raised about $55 million in capital since its 2013 founding, hadn’t fielded other acquisition interest, Giannaros said.

Initial conversations starting last November revolved around a partnership between the two companies as Bolt sought to get into crypto, and "it was a pretty hard-fought battle" to convince Giannaros and his team to be acquired, Kuruvilla said.

Since the talks got underway, Bolt had a major change in leadership in late January, with Kuruvilla replacing founder Ryan Breslow as the CEO days after Breslow went on a Twitter tirade against Silicon Valley.

Bolt bulked up for the purchase when it raked in $355 million in a January fundraising round that valued the company at $11 billion. Since its founding in 2014, Bolt has collected $963 million in capital.

Kuruvilla called Wyre "the Stripe in crypto," as it's the only company with a comprehensive API solution that spans crypto needs. Giannaros said the acquisition takes Wyre’s capabilities beyond the crypto-developer ecosystem and "really gets us to the next level."

Wyre's 130 employees will join the combined company. Giannaros will continue to lead the crypto business and strategy within Bolt, but his title hasn’t been finalized, Kuruvilla said. Bolt has about 700 employees.

Kuruvilla sees the move giving Bolt a leg up in the competitive e-commerce landscape, by incorporating Wyre’s blockchain-powered technology.

Bolt won’t provide more specific numbers than to say it works with thousands of merchants and has tens of millions of shoppers in its network, but the startup counts Forever 21 owner ABG among its merchant customers, and has a partnership with Adobe that allows Adobe Commerce merchants to integrate Bolt's one-click checkout.

The checkout startup has focused on giving brands more Amazon-like convenience when it comes to online checkout by storing shoppers' payment and shipping information to make subsequent checkout experiences frictionless.

"Our goal is to come out before the end of the year with a combined product, where we can provide one-click crypto for merchants out of the box," Kuruvilla said.

Kuruvilla said many of the merchants Bolt works with have a crypto strategy and seek crypto payments ability. That's because the payment option brings in new customers and shoppers paying with crypto – many of whom are younger – tend to spend more than those using credit cards, he said.

But enabling crypto payments can be a clunky process and present a big learning curve for merchants, so bringing Wyre’s capabilities in-house allows Bolt to make the process easier for its network of merchants, Kuruvilla said.

Once Wyre is integrated with Bolt, merchants will be able to accept any type of crypto payments without having to build anything themselves, and shoppers will be able to use any kind of crypto to purchase items from merchants Bolt works with, Kuruvilla said. The capability will become available to all of Bolt’s existing merchants, and makes for "a big selling point for new merchants as well," Kuruvilla said.

Now that deals like the Wyre acquisition and the partnership with Fanatics have been announced, Bolt is likely to plan its next funding round, but "we haven’t really pinned down an exact timeframe" to pursue that, Kuruvilla said.

"There's a lot of interest so we have been holding everybody back for some of the deals to finalize," he said. The company would not share a figure it's targeting for a future funding round.