Dive Brief:

- The Consumer Financial Protection Bureau on Friday announced that the agency will not fine buy now, pay later providers while they prepare to work under a new interpretive rule that treats them like credit card providers.

- The bureau “does not intend to seek penalties for violations of the rules addressed in the interpretive rule against any buy now, pay later lender while it is transitioning into compliance in a good faith and expeditious manner,” CFPB Director Rohit Chopra said in a blog post.

- Chopra wrote that he expects other federal regulators to follow a similar path, though he did not elaborate.

Dive Insight:

In May, the federal agency issued an interpretive rule that said existing laws require buy now, pay later providers to issue regular billing statements, offer refunds for returns or goods and services that are not delivered as promised, and allow customers to dispute charges.

“All of this is part of CFPB’s work to ensure consumers can file disputes and have payments paused while those disputes are being investigated, receive refunds when they return products or cancel services, and benefit from helpful periodic billing statements,” Chopra wrote in the blog post Friday.

Chopra’s post follows significant pushback from the industry. The agency’s interpretive rule became applicable on July 30, but BNPL providers and the trade groups that represent them have asked for multiple extensions. The American Fintech Council, for example, asked the agency to extend the deadline into early next year.

A CFPB representative declined to say when buy now, pay later companies will be required to comply with the rule or face penalties. Chopra’s blog post does not include a deadline.

“The announcement was only marginally helpful,” said Allen Denson, a partner at the law firm Morgan Lewis who represents financial companies. “The bureau said it's going to forestall enforcement for companies that exhibit good faith efforts, but that’s completely undefined. What is a good faith effort, what is that going to mean?”

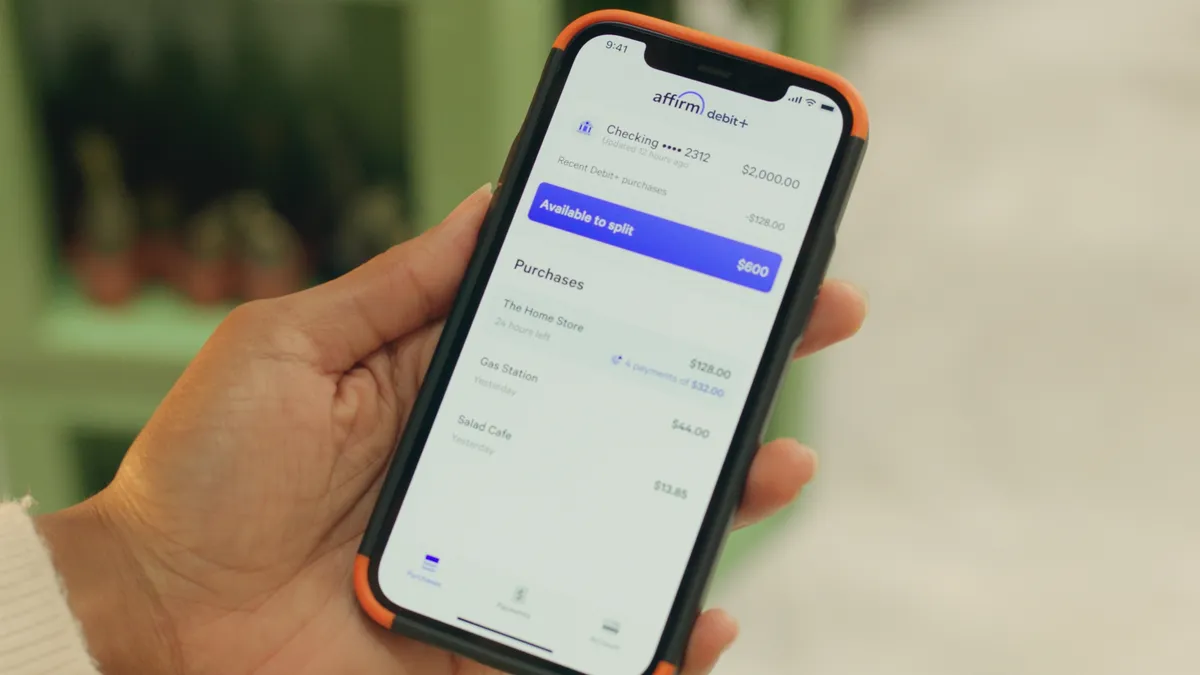

Some BNPL companies have argued that the rule unfairly lumps them in with credit card companies. Affirm, for example, told the CFPB in a letter responding to the new rules that they will confuse customers, saying “the BNPL industry would be better served by BNPL-specific regulations designed for how consumers use BNPL products.”

Digital payments pioneer PayPal also objected in a letter commenting on the CFPB’s interpretive rule and urged the agency to withdraw it, arguing that its “pay in 4” services should not be subject to regulations for credit card services, partly because the company doesn’t act as a card issuer. PayPal also argued that the agency must proceed with its usual rulemaking procedures to impose such regulations.

“In addition to the Bureau’s failure to comply with its procedural obligations or to observe statutory limitations when issuing the Interpretive Rule, the Interpretive Rule is also ‘arbitrary and capricious,’” PayPal Senior Vice President Jeffrey Levine wrote in the July 31 letter, referencing existing rules. “Importantly, it fails to recognize distinctions between the ways different BNPL providers offer the loans or explain whether (as PayPal believes is the case) these distinctions are meaningful for determining which BNPL providers issue a ‘BNPL digital user account’ that the CFPB considers to be a ‘credit card.’”

Similarly, the Swedish BNPL provider Klarna urged the CFPB to rescind the interpretive rule, calling the agency’s approach “misguided.” “BNPL products should be regulated in a way that recognizes their distinct nature and low risk compared to traditional credit cards,” Klarna said in a July 30 letter commenting on the CFPB’s interpretation.

Some 40 public comment letters on the CFPB’s new interpretive rule flowed in last month in advance of an Aug. 1 deadline.

Denson said the blog post amounts to a “wink and a nod” to the buy now, pay later industry. “It's a signal that there's not going to be an extension,” he said. The bureau is also saying it won’t enforce the rule right away, he added.

While consumer advocates and community organizations generally supported the CFPB’s move, at least one coalition argued the agency should go further. “We urge the CFPB to go further and to require BNPL providers to comply with other protections required for credit cards, including ability to repay assessments and reasonable and proportional penalty fees,” a group that included the Consumer Federation of American and the Center for Responsible Lending said in its Aug. 1 letter.

Chopra, however, put a positive spin on the industry’s reception, saying in his blog post that the BNPL industry “is responding favorably and constructively.”

“Companies understand that they shouldn’t have to compete with lenders that sidestep the law,” he wrote.

So far, no BNPL provider or trade group has stated publicly that it will challenge the interpretive rule.

That said, if such a retort surfaced, the CFPB might face an uphill battle in the courtroom thanks to a recent series of business-friendly rulings from the Supreme Court and the Fifth Circuit Court of Appeals.

In June, for example, the nation’s highest court overturned the Chevron Doctrine, which required courts to defer to a regulator’s reasonable interpretation of laws passed by Congress.

Legal observers say the Fifth Circuit is stacked with conservative judges who are skeptical of regulatory agencies and deferential to business interests.

Lynne Marek contributed to this story.