Dive Brief:

- Despite their heavy presence in e-commerce, in-store implementation of pure-play BNPL providers, such as Afterpay or Affirm, remains relatively low among large retailers, a new report on retail payments reveals.

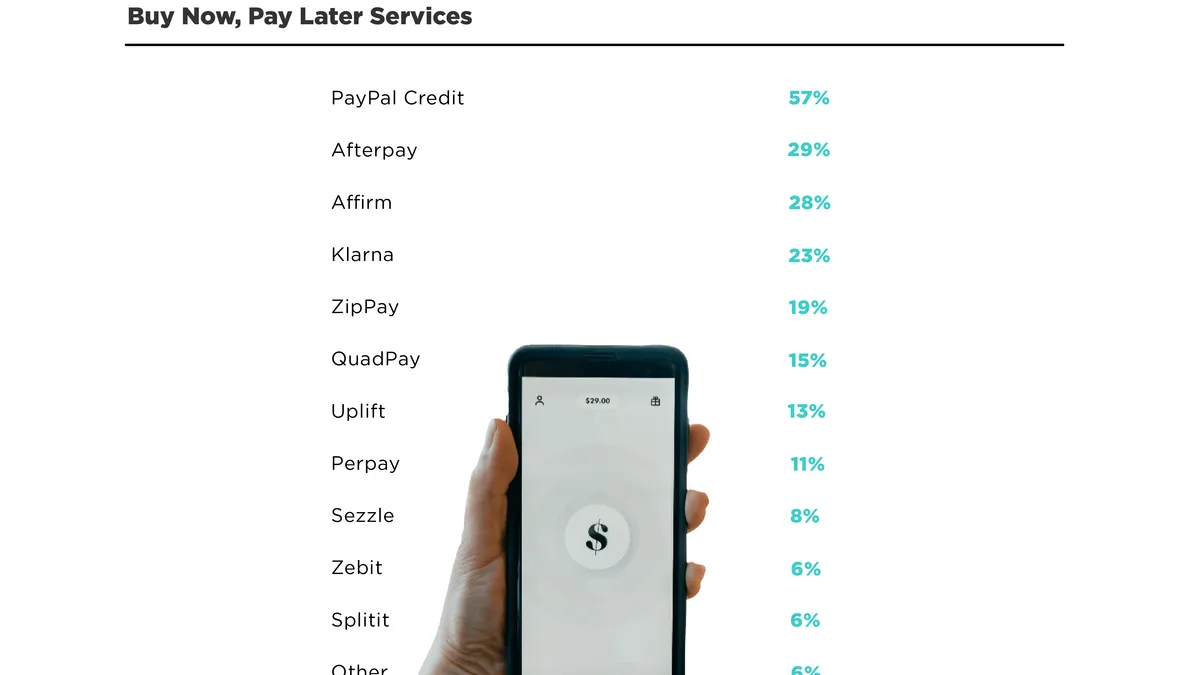

- In physical stores, three BNPL providers topped the list for retailers, with 11% offering BNPL options from PayPal, Klarna and Afterpay, according to the Forrester and National Retail Federation report, “The State of Retail Payments.” That was followed by 9% offering Affirm and 16% offering one of several smaller players like Sezzle or FlexPay, the report last month said.

- The most popular BNPL option in stores currently is store-branded: About 21% currently offer their own installment option. Overall, 38% of retailers polled said they offer a BNPL option in stores. About 57 retail professionals weighed in on BNPL implementation as part of the report, published Sept. 13.

Dive Insight:

About 43% of retailers have added at least one BNPL option on their websites, and one-quarter offer two or more, Forrester discovered. But as shoppers’ spending habits have shifted, BNPL providers are increasingly targeting offline growth. “That’s kind of the next frontier for a lot of these buy now-pay later folks,” said Forrester senior analyst Lily Varon.

E-commerce exploded while consumers were house-bound during the COVID-19 pandemic, but they’ve since returned to stores to shop as the pandemic has ebbed. That’s presented a challenge to BNPL players whose financing options gained steam during that online shopping surge. Companies like Block-owned Afterpay have seen growth rates slow as a result of consumer spending shifts.

In response, these lenders are pursuing new avenues of growth. Affirm’s Chief Financial Officer Michael Linford recently said the company aims to “crack the offline nut” in part with a debit card it’s rolling out. Klarna, too, has put BNPL on a card to allow its customers to opt for installment payments anywhere they shop.

Meanwhile, Forrester’s data reveals large merchants tend to lean more on their own in-house financing options. The installments concept can be broad, Varon noted, because merchants might consider revolving credit or layaway options falling under that category. Varon also expects store-branded BNPL will become more popular.

With BNPL-involved purchases, merchant partners pay a per-transaction fee that’s generally higher than credit card interchange fees. These merchant fees have dipped in recent years, though, due to increased competition in the BNPL market.

That’s partly what’s led BNPL lenders to focus more on attracting customers through their own apps, rather than relying on merchant partnerships, the Consumer Financial Protection Bureau’s recent report noted.

Within a BNPL provider’s app, shoppers making a payment for a previous purchase might notice a deal on an item and pursue that purchase from there. In that scenario, BNPL firms issue a single-use virtual card that customers can use with non-partner merchants, and the BNPL providers share in the interchange fees collected, the CFPB said.

About 19% of all U.S. adults used BNPL at least once to make a purchase in June and July, according to Morning Consult data from August. That share had not dipped below 14% in more than a year.

Among retailers, the Forrester report discovered PayPal’s BNPL option is most common online – 23% currently offer it. About 20% offer Afterpay online currently, 20% offer Klarna, 19% offer a BNPL option from a smaller player like Sezzle or FlexPay, 15% offer a store-branded financing option and 13% offer Affirm.

The Forrester report also revealed retailers are adding more digital wallet options, both online and in stores. PayPal, Apple Pay and Google Pay are currently most commonly offered online and in stores among retailers polled.

Unsurprisingly, given cryptocurrency’s volatility, almost two-thirds of retailers don’t plan to accept crypto payments in the next three to five years. Most of that group cites lack of consumer demand, while nearly 60% pointed to regulatory uncertainty surrounding crypto.