As consumer use of buy now-pay later skyrockets, credit reporting agencies say they're adapting to include more data from such installment payment transactions in consumer credit reports.

Equifax declared this month that in February it will become the first consumer credit bureau to standardize a process for incorporating BNPL transactions in credit reports. Its two big rivals, TransUnion and Experian, won't be far behind. They've teased their own BNPL approaches, as the regulatory chatter about BNPL grows louder.

Big name BNPL providers in the installments space, like the Swedish company Klarna and its U.S. peer Affirm, say they’re in conversation with these credit bureaus about reporting data to help both lenders and consumers.

While some BNPL plans for pricier purchases are added to credit reports, many aren’t reflected, particularly the smaller, shorter installment plans, which total billions of dollars for BNPL providers. The moves by credit reporting agencies to capture more of such transaction history underscore BNPL's advance into the mainstream as it matures. Some BNPL providers see these steps as ways to move the industry forward and ensure consistency.

By using a newly created code to identify BNPL tradelines, Atlanta-based Equifax believes adding these installment plan responsibilities to credit reports – specifically, those involving four biweekly payments – will provide a more comprehensive look at consumers’ financial obligations, said Tom Aliff, risk consulting leader at Equifax.

Buy now-pay later has become an increasingly popular checkout option with consumers, allowing them to divide a purchase into equal installments over a defined period of time. BNPL providers, for the most part, skip a credit check when shoppers opt for installment plans, or do a "soft pull" on their credit histories.

As the service has become more popular with consumers, BNPL firms have come under increasing scrutiny, with regulators and lawmakers concerned about consumers overextending themselves and companies mining personal data for marketing purposes.

More than 70% of BNPL users who've fallen behind on payments believe their credit score was negatively affected, a Credit Karma survey found.

'Blind spot' for lenders

"The data that's currently not being reported fully in this regard is really a blind spot to lenders," Equifax's Aliff said in an interview. On the flip side, consumers who make on-time payments aren't benefiting.

There hadn't been a mechanism thus far to accept and interpret this "pay-in-4" data, Aliff said, which prompted creation of the code. The company has been testing it with customers since August.

The new code will be implemented early next year, said Amy Frasher, fintech product manager for Equifax. That will mean more buy now-pay later providers working with the company to report data, especially in light of the Consumer Financial Protection Bureau probe announced last week, she said in the interview.

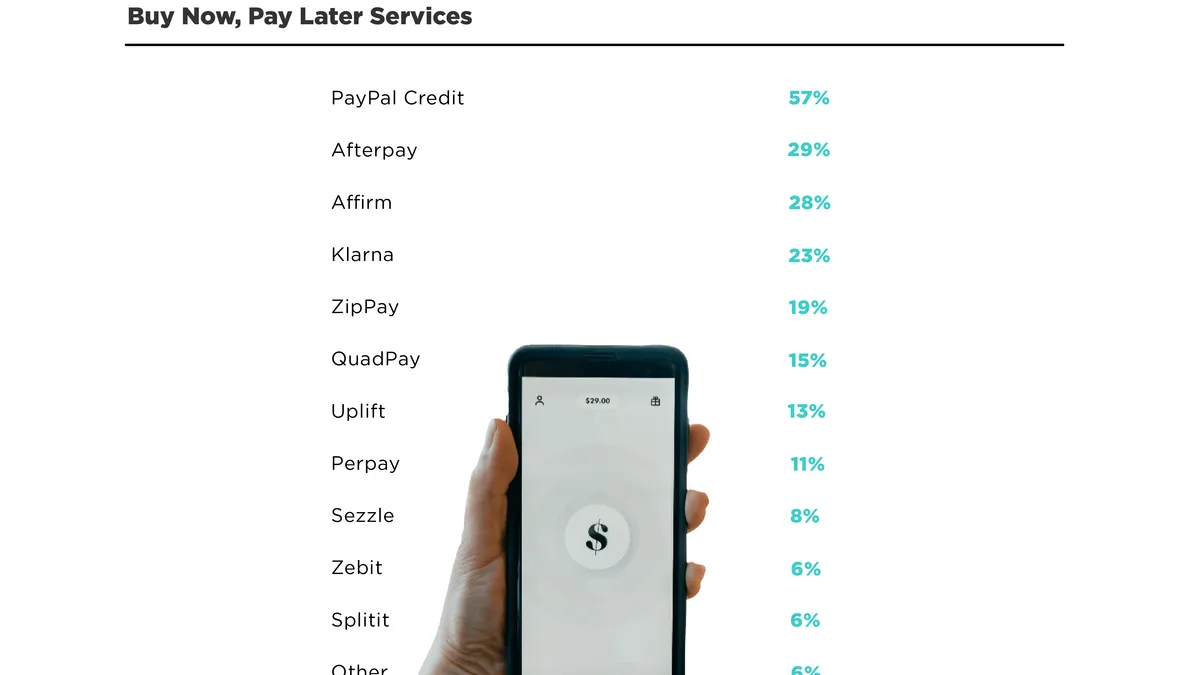

The CFPB ordered the largest BNPL companies – Affirm, Afterpay, Klarna, Zip and PayPal – to provide information on the risks and benefits of the financing. Among other issues, the CFPB is focused on the concern that BNPL targets consumers who lack credit history.

An Equifax spokesperson said the timing of the company's announcement relative to the CFPB's probe was "just coincidental."

Consumers who make their BNPL installment payments on time might get a FICO score boost, perhaps by as much as 21 points, according to an Equifax study.

TransUnion approach

For its part, Chicago competitor TransUnion believes BNPL is a new type of obligation that "the existing credit ecosystem in the U.S. is not ready to support," said Lisa Pagel, senior vice president and consumer lending business leader at TransUnion.

There are obstacles for credit reporting agencies when it comes to including BNPL plans. Currently, credit reporting systems aren’t accustomed to biweekly payment data, and the delay between account opening and sending information to credit bureaus causes problems, according to a report from The Wall Street Journal.

"The frequent transactional nature of these loans has the potential to unduly negatively impact consumers even when they pay as agreed," Pagel added in an emailed statement.

There have been concerns credit bureaus aren't set up to receive information every few weeks, "and we can assure you that that's not the case," an Equifax spokesperson said.

TransUnion agrees that data should be reported, and that such reporting will offer a clearer picture of a borrower.

"We’re well on our way to bringing a solution to market that will make this data available without having an undue impact on existing scoring models," Pagel said in the statement.

A company spokesman declined to elaborate and wouldn't specify timing on the new "solution," although the credit bureau told The Wall Street Journal it’s working with BNPL providers to enable reporting in 2022.

A spokesperson for Dublin-based credit reporting agency Experian said it already includes millions of tradelines from large BNPL providers on consumers' credit reports, and is working with industry partners to include even more information.

"We are currently innovating new solutions that will provide additional insights into how these transactions impact consumers' financial health and overall credit risk," the Experian spokesperson said in an emailed statement. "In short, there will be more to come from Experian on buy now-pay later very soon."

Affirm backs adjustments

Affirm, which shares payment history of some larger loans, supports efforts to implement standardized credit reporting for BNPL transactions in a way that benefits consumers and the financial system, and will maintain its ongoing dialogue with credit reporting agencies, said Matt Gross, Affirm’s director of financial communications, via email.

Reporting to credit bureaus lets responsible underwriters better assess risks for consumers and keep them from becoming overextended, he said.

"We have been actively engaged with credit reporting agencies to optimize reporting standards for buy now-pay later transactions, enable consumers to build their credit histories, and have on-time payments accurately and positively reflected on their scores," Gross said via email.

A Klarna spokesperson said the BNPL company wants to share data with credit bureaus to enable better lending decisions and is currently discussing how its data can fit existing molds, but the credit rating agencies "need to update their systems to accept our data to benefit customers," the majority of whom pay on time and in full.

"We’ve been working with CRAs to help them with this," the Klarna spokesperson added via email. "Regulation and stronger oversight would bring value for consumers in this area," the spokeperson said.

Changes to credit reports come when there's a big impact to the market, Aliff noted, and Equifax is trying to get ahead of the massive growth rates predicted for BNPL. "Given where the CFPB is standing on it, it is a big deal," Aliff said.