Buy now-pay later services are primed to disrupt the $8 trillion payments industry as more consumers purchase items–big and small–in three, four, or six installment payments. New BNPL players are flocking to the sector, partnerships are flourishing, and merchants are discovering they need to make plans to join in or risk being left behind.

BNPL companies raised a record $1.5 billion in funding in 2020 — a 42% increase over 2019, and an even larger leap over the $110 million raised in 2016, according to a March CB Insights Report. Last year, the funding across 20 investments included Klarna raising $650 million.

As the pandemic led shoppers to more online purchases, consumers were attracted to the short-term, often interest-free payment plans, and shied away from credit cards.

“A lot of people were trying to hold onto cash because of the pandemic, because they weren’t sure what was going to happen,” said Sheridan Trent, an analyst with The Strawhecker Group, a major payments consulting firm. “When they see an item for $200, but they only have to come up with $50 over four payments, that’s psychologically very attractive.”

Four companies command field

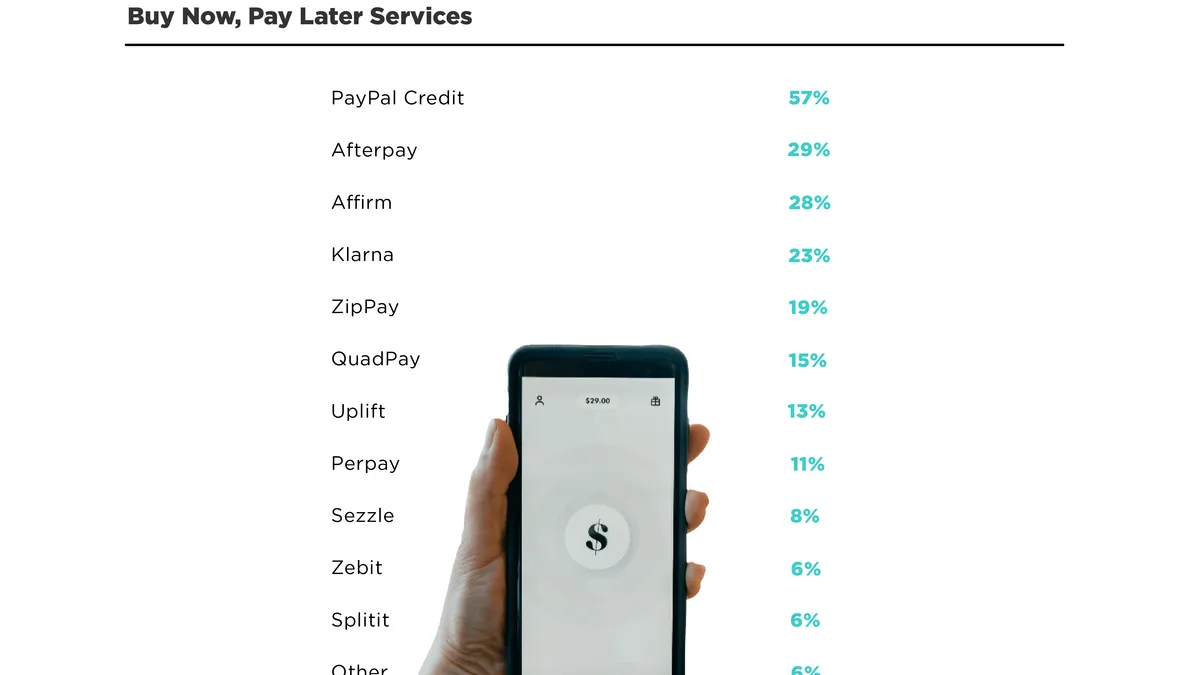

According to a Cardify analysis cited by the CB Insights report, four key players dominate the BNPL space in the U.S. These include: the Australian pioneer Afterpay, which U.S. payments titan Square recently agreed to acquire for $29 billion; the Swedish company Klarna; Minneapolis-based Sezzle; and Australian rival Zip, which last year agreed to acquire Quadpay.

Afterpay holds the largest share of total BNPL transactions (70%), followed by Klarna (12%), Sezzle (10%), and Zip (9%), according to the CB Insights report. Another major U.S. player, San Francisco-based Affirm was excluded from the analysis because, unlike the other four-installment firms, Affirm’s primary offering has been point-of-service lending that is repaid over longer terms and used for larger purchases, the report said.

Among the top-funded BNPL players cited in the CB Insights Report, Klarna has attracted the largest share of venture capital dollars, including from institutions such as mega Chinese payments company Ant Group, the retailers Macy’s and H&M Group, and card company Visa’s venture arm. In addition this year, Klarna announced it raised $634 million in new funding in June led by SoftBank.

Online payments provider PayPal this month added to its BNPL options with the purchase of Tokyo-based Paidy for $2.7 billion. It offers a variety of installment payment options through different services.

Darren Mowry, chief revenue officer at card company Marqeta, expects even more new BNPL entrants. “While there are a lot of players, we still don't see that we're as far down this path as we're going to go in terms of how big this opportunity could be and what consumer needs are,” he said

Marqeta, which services credit, debit as well as BNPL clients, reported that its BNPL revenue jumped more than four-fold in the second quarter this year relative to 2020.

“It’s a very crowded space,” said Ted Rossman, a senior industry analyst at card advisory firm creditcards.com. “There’s probably too many flavors of it right now and its confusing and fragmented both from a consumer and merchant standpoint. There’s ample room for consolidation.”

A new Cardify report on the Square-Afterpay deal noted a split between those who viewed the acquisition as affirmation of BNPL as a sustainable financial model and those who saw the all-stock acquisition as a sign that Square was unwilling to risk its cash.

Amazon’s August announcement that it would partner with Affirm could be a game-changer. That giant online merchant could play a key role in spreading the word about BNPL, Rossman said.

A Marqeta report on credit spending and BNPL usage released Thursday noted that nearly half, 47%, of U.S. respondents in a global survey conducted in June said they’d used a BNPL service at least once. Of those users, 71% had increased their personal usage in the prior twelve months.

“While credit cards may still be king, buy now-pay later is not a passing fad,” Marqeta’s Mowry said. “COVID has been an accelerant, but buy now-pay later is not going to go away after COVID.”

Although BNPL transaction fees paid by merchants are typically 5% to 7%, equal to about double what credit card companies charge, retailers aren’t balking because this payment option “is driving up the average order value,” said Strawhecker’s Trent. “Most consumers report they were spending more if there was a buy now-pay later option available than they otherwise would.”

Less regulation in field except for California

Still, there is a general lack of regulation and consumer protections compared to those that apply to credit cards, with the exception of oversight in California, where regulators are keeping a more watchful eye. In December 2019, the California Department of Business Oversight called out Sezzle for “illegal unlicensed lending” in the state. It ordered Sezzle to refund $282,000 to California consumers and pay a $28,200 penalty, and it has since then been operating with a lending license.

Similarly, in March 2020, Afterpay paid a roughly $1 million settlement with the California agency, which found that the company structured products to “evade otherwise applicable consumer protections” and made loans to California residents without a valid license.

At the federal level, the Consumer Financial Protection Bureau published a blog piece in July issuing warnings about BNPL services, noting the possibility of consumers overextending their finances, or encountering unexpected late fees and other charges.

Clarification: The story has been updated to note the CB Insights report was first published in March.