Dive Brief:

- Digital payments company Block, parent to Square and Cash App, plans to shrink its workforce by about 8% over the next year, its executives said Thursday. The company, which had about 13,000 employees as of the end of the third quarter, will cap its headcount at 12,000, Block CFO Amrita Ahuja said.

- “We expect to be a smaller team by the end of 2024, compared to where we are today,” Ahuja told analysts during the company’s third-quarter earnings conference call.

- San Francisco-based Block will take steps to reach the headcount goal throughout the year, including through performance management and centralizing teams and functions to decrease duplication, said Ahuja, who is also Block’s chief operating officer.

Dive Insight:

Block’s third-quarter loss nearly doubled to $29 million, compared to the year-earlier quarter, according to the company’s shareholder letter. Net revenue for the quarter rose 24%, to $5.62 billion. Excluding bitcoin revenue, revenue increased 16% to $3.19 billion.

The move to pare the company’s workforce — expanding on job cuts Block confirmed last month — was mentioned as part of an increased focus on profitability and efficiency. Earlier this year, Block pledged to focus investments on customer retention as it pursues profitable growth over the long term.

In a Friday note to investor clients, Bank of America Securities Analyst Jason Kupferberg referred to the employee cuts as a “~10% reduction” compared to the company’s headcount as of the end of the Q3.

The company also aims to shave costs in areas such as corporate overhead, real estate, travel and vendor relationships, Ahuja said Thursday. The company’s third-quarter operating expenses jumped 18% year over year, to $1.91 billion, according to its quarterly shareholder letter.

“We may incur expenses, including restructuring costs, in the short term to implement these initiatives, but we expect to benefit from these actions in future periods,” Block said in its quarterly filing with the Securities and Exchange Commission.

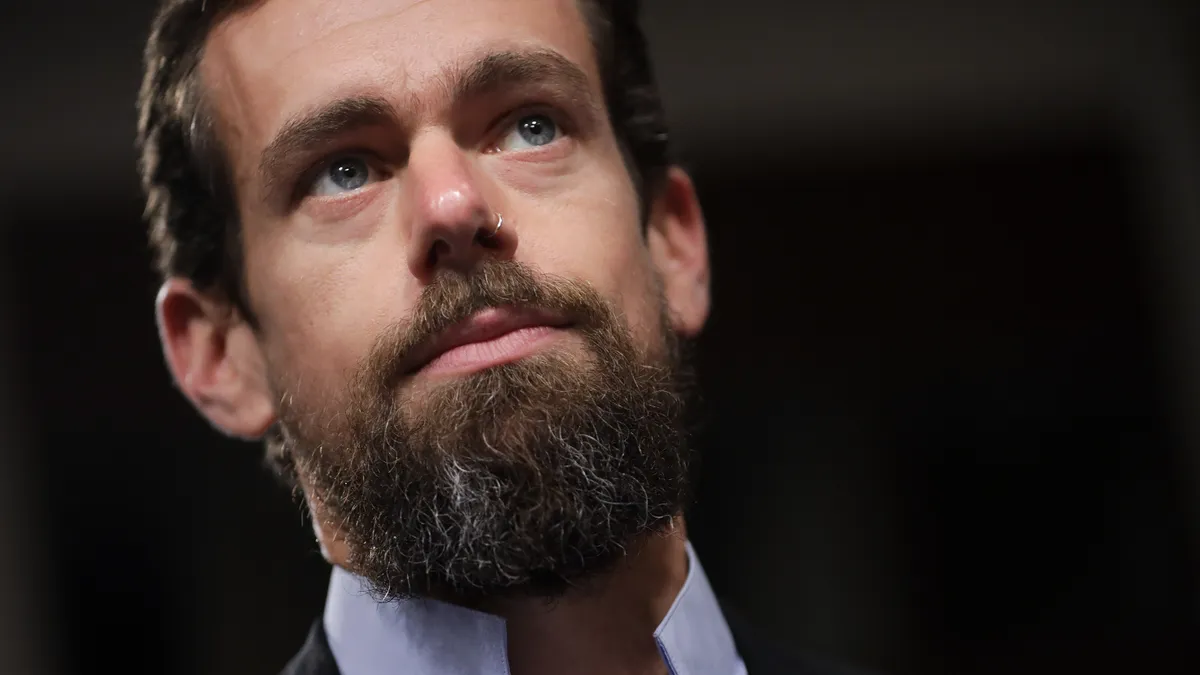

During Thursday’s call with analysts, Block Head Jack Dorsey laid out his priorities at merchant business Square, which he took the helm of last month following the departure of Square CEO Alyssa Henry. Those include doubling down on Square’s platform and its features, using artificial intelligence more effectively and taking a more local approach, such as with sales.

“My first two weeks running Square was focused on, what are we working on and why?” Dorsey said. “To be very frank, I believe we were getting in our own way throughout the company,” Dorsey said. Since taking the helm of Square, Dorsey said he’s noticed “a lot of silos, a lot of redundancy, a lack of desire for teams to work together.”

He also discovered “unclear decision-making throughout the company, which led to a lot of slowness, especially on the Square side,” Dorsey said. Also under the Block umbrella are peer-to-peer payments business Cash App and Australian buy now, pay later provider Afterpay.

In the past, Square “has been hampered” by not taking more novel approaches to sales that its competitors have employed, Dorsey noted. The business is removing those constraints to learn more quickly and invest in proven approaches, he said.

Much of what’s holding Square back is its onboarding process, he mentioned. The business still obtains a significant chunk of seller customers through self-serve channels, whether that’s buying hardware on Square’s website or through e-commerce site Amazon, and Square’s onboarding flow for those merchants “just takes way too much time,” he said.

In seeking to improve that, Dorsey pledged “pretty quick results over the next year.”

Dorsey said he plans to lead Square until the business unit has made a “significant return to growth” and becomes more innovative and inventive. Square’s gross payment volume rose 11% for the third quarter, to $55.7 billion, the shareholder letter said. The share of Square clients that it considers its large merchants edged up one percentage point over the prior quarter, to 41% of its overall client base.

“I’ll know when it’s time and when Square’s set up in a way that we look to find a dedicated lead,” he said. “But this move has enabled me to see a lot of the problems, not just within Square but across the company, and work to fix them very quickly.”

Cutting too aggressively could risk growth at the business, some analysts who follow the company mentioned in a note to investors about the earnings call. “But ultimately we view Dorsey's more active role in Seller and the broader business positively as he brings back a leaner and more experimental corporate culture,” analysts with TD Cowen wrote in a Friday note to investor clients.