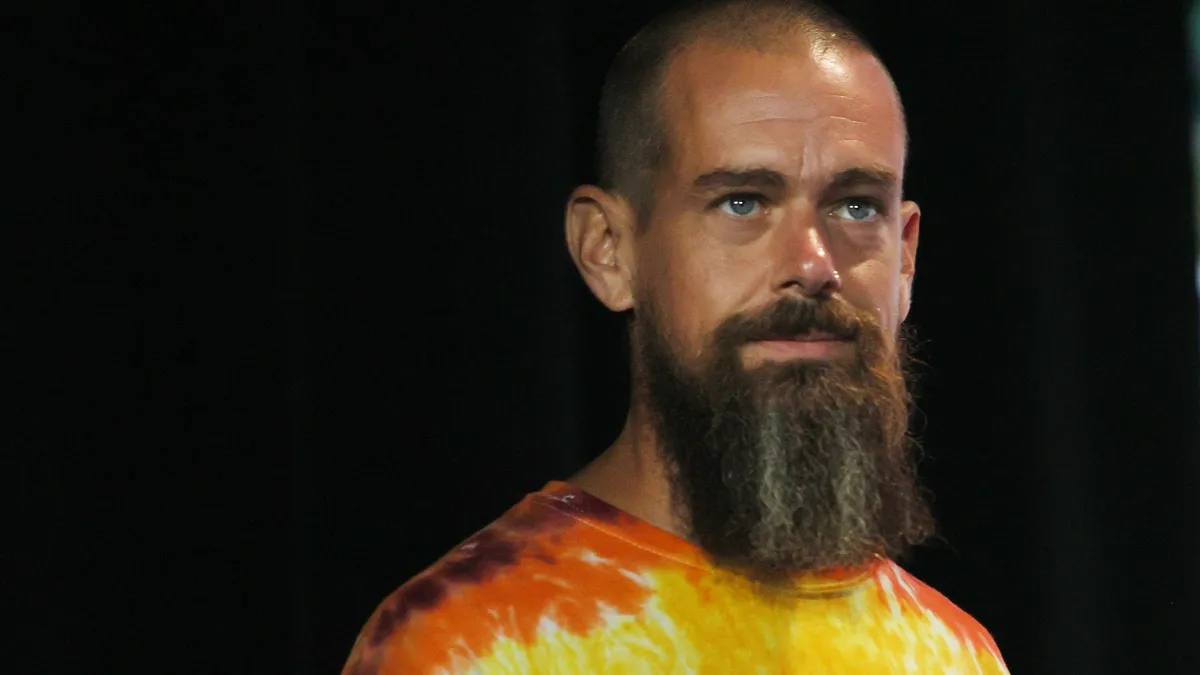

Block is moving beyond payments, with CEO Jack Dorsey making clear Wednesday that he sees bitcoin as the company's next frontier.

“We are no longer just a payments company,” Dorsey said at the company’s virtual investor day, adding that Block executives see a competitive advantage in intertwining the company's Square, Cash App, Afterpay, Tidal and TBD entities.

Founded in 2009 as Square, the company originally catered solely to smaller merchants with its trademark white square card reader, charging them a fee to process their orders. It’s since grown to offer a slew of software services to those Square sellers, and built out a multi-purpose financial services tool called Cash App. Dorsey has said he sees Square as a competitor to financial services companies and upstart neobanks.

He continues to fill out that portfolio of services. Last year, Block acquired buy now-pay later provider Afterpay for $29 billion and music streaming platform Tidal for $297 million.

Now, Block has big ambitions when it comes to bitcoin. Dorsey told investors that the digital asset has become “an extraordinary trend towards an open standard of global money transmission,” giving Block the opportunity to move faster globally.

"We believe the Bitcoin standard will become the internet standard," Dorsey said. "And by helping it become that, we will increase access to the global financial system and the economy and increase the potential for business."

While Block’s bitcoin-focused operations, which include TBD, its bitcoin hardware wallet and its bitcoin mining system, are still in the early stages of their development, Dorsey expects they’ll become “massive parts of our business in the future.” The company has designed those to address gaps in the market, he said.

Chief Financial Officer Amrita Ahuja said the company sees “profound long-term potential” in bitcoin, but suggested her company will improve on the cryptocurrency by speeding up its processing of payments by tapping the Lightning Network. Bitcoin “has the potential to disrupt existing payment networks with the growing adoption of the Lightning Network,” Ahuja said.

Cash App Lead Brian Grassadonia said there are “multiple opportunities for monetization” with bitcoin. About 10 million Cash App users have bought bitcoin since the cryptocurrency was introduced in the app in 2018, the company has said.

The company's bitcoin pronouncements came as bitcoin has tanked in value and is on a seven-week losing streak, per CoinDesk. None of the executives addressed the cryptocurrency's long-term volatility or recent swoon.

Afterpay integration

On Tuesday, the company announced Afterpay has been integrated into Square for in-person sellers in the U.S. and Australia, following its introduction for e-commerce point-of-sale three months ago.

According to Block, the average transaction size of U.S. and Australian consumers using Afterpay at Square's online sellers is three times bigger than with non-BNPL purchases.

Nick Molnar, a cofounder of Afterpay who now co-leads that business unit at Block, also spoke Wednesday at the investor day. He said Afterpay processed close to $20 billion in gross merchandise value in 2021 and generated about $600 million in gross profit.

As Block executives eye global growth, Square Lead Alyssa Henry said they believe Afterpay will serve as a medium-term accelerant to those aspirations in markets outside the U.S.

Linking the company's units

The company's executives touted the benefits of linking Block’s various businesses, particularly the growth opportunity envisioned by connecting Square, Cash App and Afterpay and cross-selling those services. Dorsey noted “there are very few examples of organizations pulling this off.”

“The more connections between our systems we create, the more resilience our overall company enjoys, in addition to competitive advantages,” he said.

Ahuja said the company sees about a $200 billion addressable market for Square and Cash App. Currently, the company said it's penetrated less than 3% of the market.

On Wednesday, Square also announced the acquisition of Moldova-based GoParrot, a digital ordering and marketing platform for restaurants. A company spokesperson would not share the terms of the deal. Analysts with Baird Equity Research said in a report they don't expect the acquisition to be consequential to Block's revenue or gross profit.

GoParrot is a "long-time Square partner" whose products already integrate with Square, according to a press release. Through GoParrot, Square sellers have access to a customizable white-label app that restaurant customers can use to place orders.