Dive Brief:

- Bitcoin Depot CEO Brandon Mintz believes a new California law will “create economic challenges” for his company and other cryptocurrency ATM operators, he said in a Monday interview. The new law is aimed at addressing scams involving cryptocurrency ATMs, machines that convert cash into digital currency.

- The new law, signed last month by Gov. Gavin Newsom, limits the daily amount of money that can be accepted or dispensed by a machine to $1,000 per day. It also limits the fees an operator can charge at 15% of the transaction’s value.

- Mintz did not believe those limits would protect consumers. Instead, he argued that another bill signed into law last month “will actually be the one more focused on preventing scams and fraud because that bill is going to require a license for various types of crypto companies, including ourselves.”

Dive Insight:

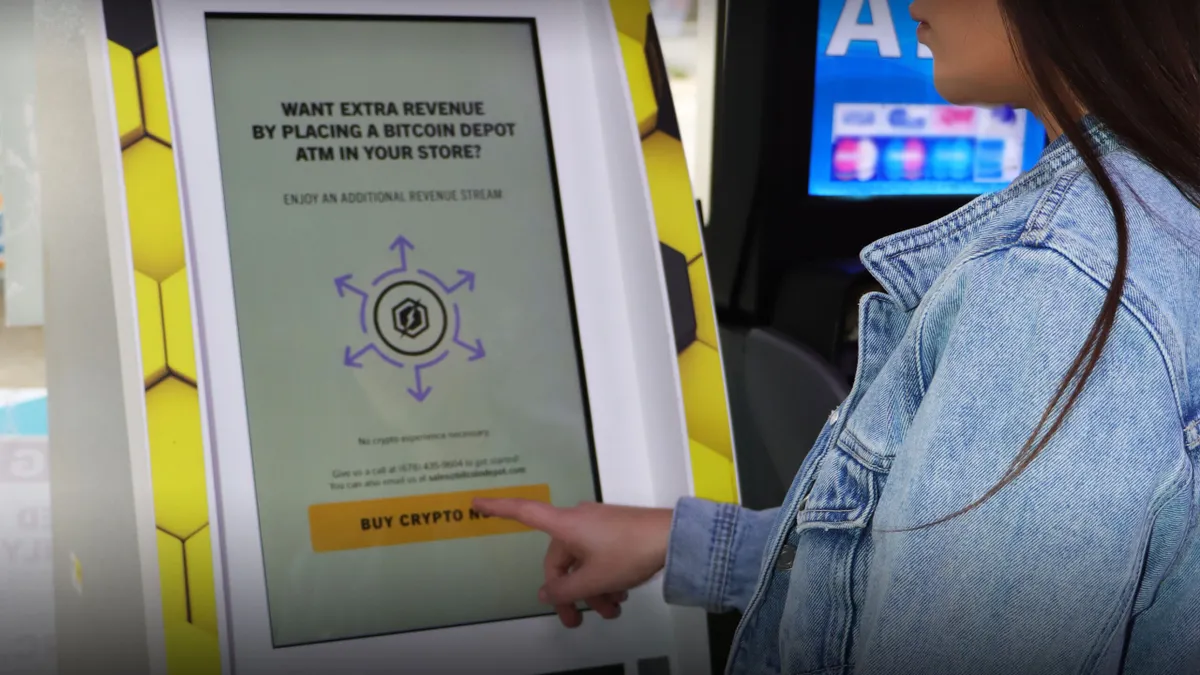

Bitcoin Depot already takes multiple measures to prevent scams including physical stickers on the machines, on-screen warnings, company blog posts, emails and text messages, Mintz said this week. He noted the new California transaction fees and fee caps are unique to that state.

“We also ask the customer to verify that the wallet that they're sending the Bitcoin to is their own personal wallet,” Mintz said. “We don't send crypto to another person on behalf of whoever's standing in front of the machine.”

Atlanta-based Bitcoin Depot has about 7,000 bitcoin ATMs in 48 states and 10 Canadian provinces, Mintz said. And on Thursday it announced a partnership with ATM company CORD Financial Services to distribute more machines across the U.S., according to a press release.

The cryptocurrency ATM operator was publicly listed on the NASDAQ stock exchange in July, the first company of its kind to do so, according to a report from cryptocurrency news site Decrypt.