Dive Brief:

- Bank of America equity research analysts Tuesday downgraded the stocks of buy now-pay later provider Affirm and card companies Discover Financial Services and Synchrony Financial, noting all three have significant exposure to consumer credit risk and lower-income consumer spending.

- Affirm and Synchrony were downgraded from “buy” to “neutral,” while Discover was downgraded from “buy” to “underperform,” according to an analyst note to investor clients.

- Spokespeople for San Francisco-based Affirm, Stamford, Connecticut-based Synchrony, and Riverwoods, Illinois-based Discover declined to comment.

Dive Insight:

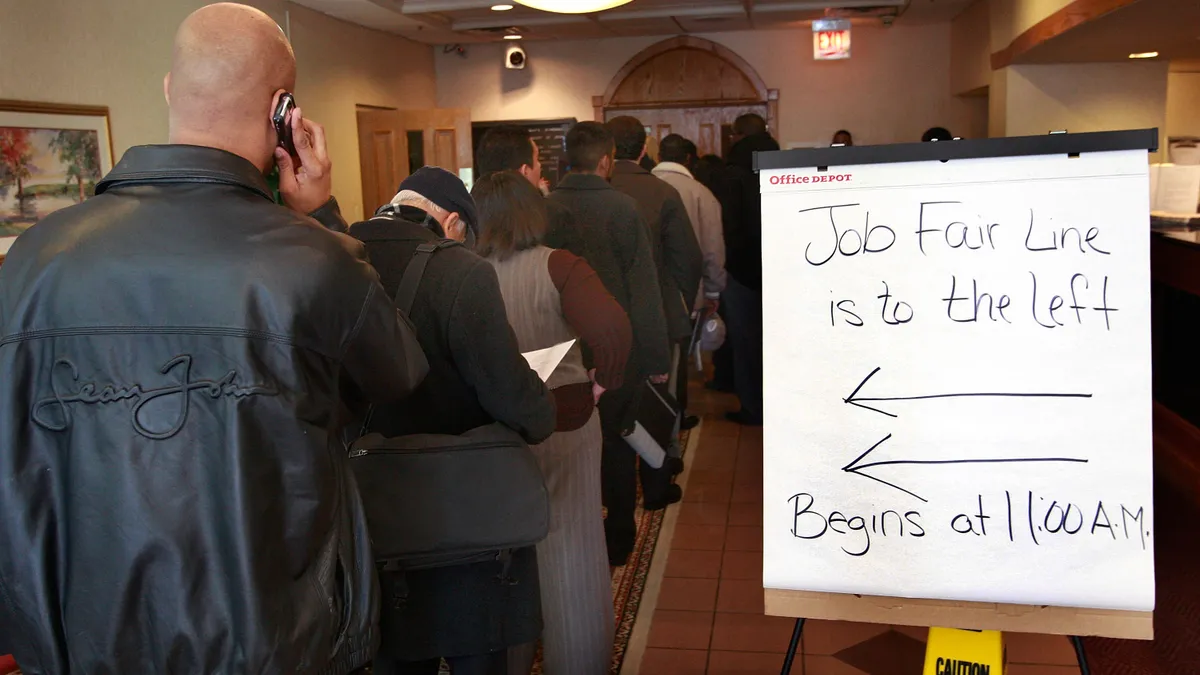

In an effort to tamp down rising inflation, the Federal Reserve this year has increased interest rates at the fastest pace in more than a decade, causing employers to begin chopping their workforces amid an economic slowdown. As a result, many economists have predicted a potential U.S. recession next year.

As of the third quarter, loan balances for pure-play card issuers were up 21% on a year-over-year basis, Bank of America analysts said. “Strong loan growth over the past 18 months has also set the stage for credit losses to increase prospectively,” the analysts wrote in the Dec. 13 note to investor clients.

Although spending levels have been resilient thus far, including during the Thanksgiving weekend shopping period, Bank of America economists predict a darker forecast next year. Consumer spending is likely to become more conservative in 2023, with the savings stockpiled during the COVID-19 pandemic turning into “precautionary savings,” analysts wrote.

Despite the growth in BNPL benefiting Affirm, a potential recession would be “a material headwind” for the company, analysts projected. That’s because it would reduce discretionary spending and put pressure on credit metrics. Overall, “the higher rate environment pressures funding optionality.”

Affirm, which provides customers with installment financing, has said it’s considering fee increases for consumers and merchants as it seeks to reduce losses.

For Discover, and its issuer-network model, the increased risk of a recession also poses challenges, the Bank of America analysts said. A recession may cause credit costs to rise rapidly and squeeze profit margins, they explained.

Some card issuers have already noted slowing sales growth. For Discover, card sales were up 14% in September, then dipped to 11% in October, and slid further to 9% in November, CEO Roger Hochschild said during a Goldman Sachs conference appearance last week.

Everyday spending has remained strong, but retail and travel spending have softened, Hochschild said. The card company’s customers are trading down in terms of their retail or grocery expenses and eating out less, he said.

At Synchrony, which issues credit cards on behalf of retailers, the company’s “enviable merchant partner portfolio” could help it withstand a mild recession, the analysts noted.

Delinquencies and charge-offs for major credit card issuers have begun rising, although they remain below pre-pandemic levels. Discover and Synchrony are among card issuers that have added to their credit loss provisions in the third quarter. Discover noted unemployment is the biggest driver of worsening credit metrics.

“Higher unemployment rates will drive higher net charge-offs, require higher reserve building (i.e. higher provision expense) and therefore result in lower earnings for card issuers,” Bank of America analysts concluded.