Starbucks is a case study in closed loop payments — and according to payments vet Sophia Goldberg, it’s “the scion of greatness for digital wallets.”

Its app is the second most-used for point-of-sale transactions behind Apple Pay, according to eMarketer, and roughly $1.7 billion sat in waiting in customer mobile wallets at the end of fiscal 2023. For its app’s popularity, Starbucks gleans an endless stream of customer data and high marks of loyalty.

But Goldberg, co-founder of wallet-as-a-service fintech Ansa, wants to give Starbucks a run for its money by bringing the same data-gleaning and loyalty-shoring opportunities to smaller shops and eateries.

She wants the experience for cashiers and customers to be even better, though: She wants the service to be “line busting.”

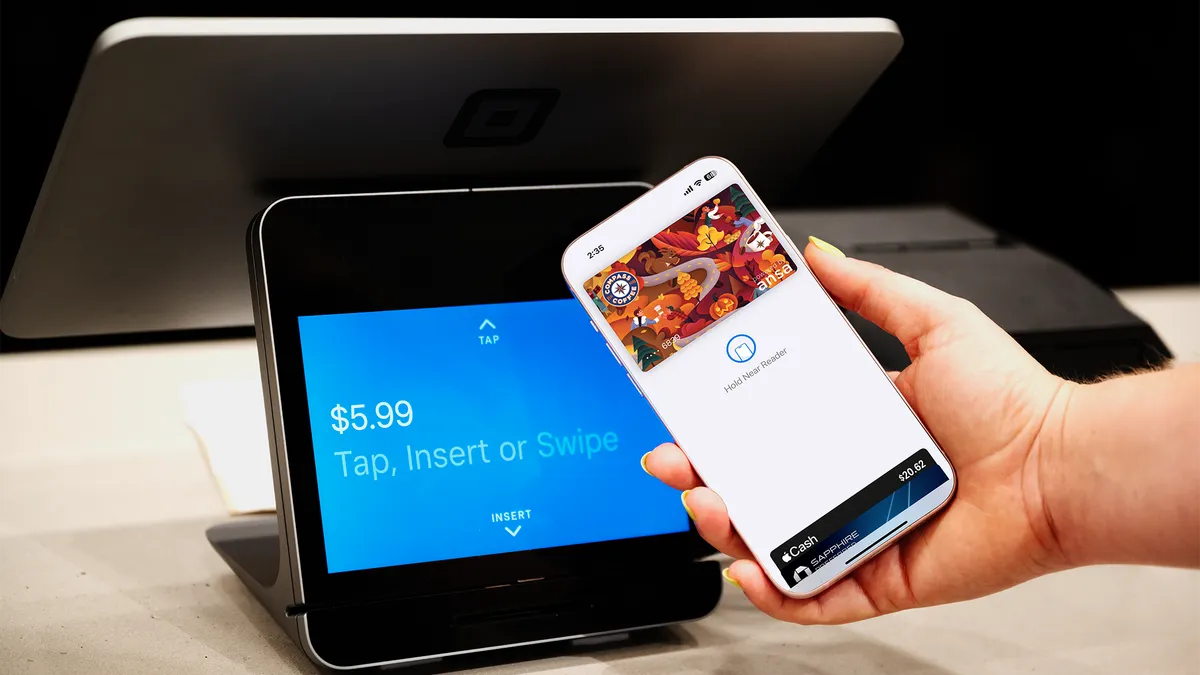

To achieve this goal, her firm on Tuesday launched an in-store capability, dubbed Ansa Anywhere, which allows any retailer or restaurant with an Ansa-powered digital wallet to let customers pay for their goods at the till with tap-to-pay. The startup is backed by about $20 million in capital, an Ansa spokesperson said.

Merchants needn’t buy extra hardware, like QR scanners, and baristas needn’t ask customers ahead of time how they’re paying to cue up the right system. Ansa Anywhere instead taps into contactless payments, a method 79% of customers worldwide are using, according to Mastercard.

While the growth of contactless payments has dramatically changed the in-store payment experience, other aspects were ripe for change.

“The world of in-store payments is really out of date,” she said. “You're looking at daisy chains of different [payment processing] providers with varying levels of modernity to their technology, and that means launching a new payment method in-store can take months or years to make sure all of the systems talk to each other, and that the consumer experience is still seamless.”

Last week, San Francisco-based Ansa quietly launched its software development kit, which can be patched onto the code of a brand’s mobile app to create within it a white-labeled digital wallet.

The kit gives merchants a mobile wallet in as little as 10 minutes, although Goldberg said most of their merchant partners take a few weeks to implement it. Once the kit is up and running, adding the in-store capability takes a day of work or less, she said.

“It's just a few changes, because the way we've built it is that the pain’s on our side to make sure all their systems talk, and we wanted to make it really easy for a brand to [use],” Goldberg said.

Michael Haft, CEO of Ansa Anywhere’s inaugural merchant partner Compass Coffee, credited Ansa with bringing “powerful payment technology typically reserved for large consumer brands to more businesses.”

“Ansa empowers businesses like Compass to punch above their weight with an awesome stack of integrated products that boost engagement, drive repeat visits, and most importantly create an even more incredible customer experience in our cafes,” he said.

Giving customers the opportunity to spend their balance in-store means they’re more likely to continue turning to their merchant wallet for payment, Goldberg said, backing up her and Ansa co-founder JT Cho’s original goal in creating Ansa: cutting interchange fees and processing fees.

Brands have control over how their card shows up in customers’ digital wallets, and they can have fun with that, Goldberg said.

“Your best 100 customers could get a version of the black card, where it looks a little different. They can do fun experiential things, like you don't get the fall card art until you order something from the fall menu,” she said. “There's a lot [experience-wise] a brand can build on top of the technology that gets a customer excited.”