Amazon, the largest online retailer, is ratcheting up its battle against card giant Visa, extending a surcharge on Visa transactions to include Australia, and disclosing now that it's offering an incentive there for consumers to dump their Visa credit card.

Seattle-based Amazon told its Australian customers on Sept. 1 that a half-percent surcharge will be imposed on Visa transactions in that country starting Nov. 1, according to a statement from an Amazon spokesperson. And if the customers ditch Visa as their “default payment method” and add an alternative, the company will give them an AU$20 gift card, the spokesperson said. (In Singapore, an SG$30 gift card was offered.)

“With the rapidly changing payments landscape around the world, we anticipate a future that is less card-centric in the coming years, and we will continue innovating on behalf of customers to add and promote faster, cheaper, and more inclusive payment options to our stores across the globe,” the Amazon spokesperson reiterated in an emailed statement yesterday that echoed the company’s comment following the Singapore surcharge.

San Francisco-based Visa didn’t immediately respond to a request for comment. (It never responded to a request for a response on the Singapore surcharge.)

Amazon’s move, which singles out Visa for the surcharges, suggests the online retail juggernaut intends to keep increasing pressure on the biggest U.S. card company. Meanwhile, a swarm of well-financed payment fintech startups is finding new ways to process payments and threatening legacy payments companies like Visa and the banks that have traditionally issued credit cards. Those incumbents charge merchants interchange fees every time a consumer presents a credit card to pay for a transaction.

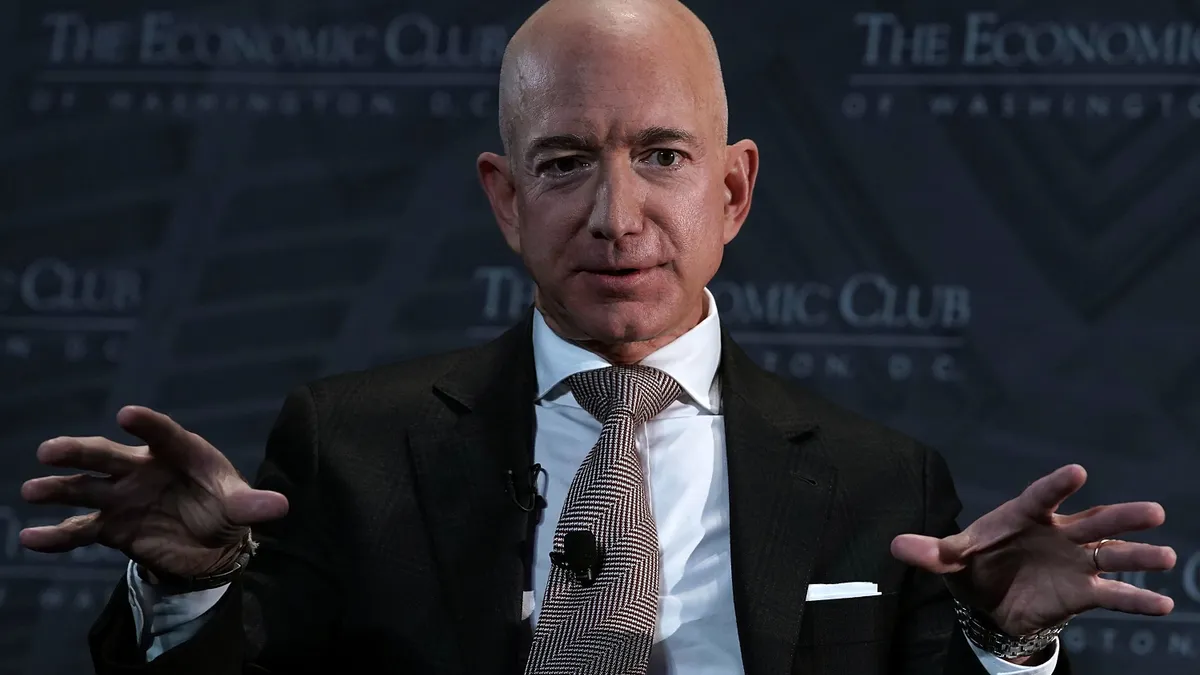

Amazon, led by billionaire founder and Executive Chair Jeff Bezos, reiterated its complaint about the expense of the cards in its statement. “These costs should be going down over time with innovation and technological advancements, which allows merchants to reinvest savings into low prices and shopping enhancements for customers. Yet, despite these advancements, some cards’ cost of payments continue to stay high or even rise.”

Even as it imposed the surcharge, Amazon said it doesn’t want Australian customers to have to pay it, and offered the $20 gift card as a testament to that commitment. It blamed “Visa’s continued high cost of payments” for its extension of the surcharge to a second country, and suggested it might not stop here. Asked whether the Amazon surcharge will show up in more countries, the spokesperson said by email, “These are the first countries we’ve decided to make changes in, but this is a global issue and is not isolated to Australia and Singapore.”

The half-percent Amazon surcharge is scheduled to go into effect Sept. 15 in Singapore.

The Amazon surcharge extension delivers another blow to Visa, which this year has faced increased pressures from U.S. lawmakers and regulators focused on keeping a lid on card fees. Visa and Mastercard postponed a scheduled credit card fee increase on transactions for the second year in a row this year after pushback.

Merchant groups have complained for years that the fees they shoulder to process credit and debit cards are overburdensome. With Democrats in control of Congress and the White House this year, their concerns appear to be getting renewed attention.

Sen. Dick Durbin, D-IL, earlier this year continued his crusade against card fees, excoriating the industry over the now abandoned plans to raise fees. He helped win a cap on debit fees in an amendment to the 2010 Dodd-Frank Wall Street Reform and Consumer Protection Act, but credit card fees have remained unrestrained.

More recently, the Federal Reserve Board proposed this summer to clarify a rule requiring that two unaffiliated card networks be available to process all debit card transactions in the interest of reducing fees for merchants. The Fed got an earful of clashing comments from merchants, banks and others this month on that proposal, including a letter of opposition from Visa.

“Visa believes that significant regulatory changes should only be undertaken with the goals of enhancing integrity, trust and confidence in the payment system and/or addressing significant market failure, with careful consideration of the impact on all stakeholders,” Visa’s July 23 comment to the Fed said. “We believe the Board’s Proposal addresses neither.”

In commenting on the impact of the surcharge for Visa, a Baird Equity Research report said "the fear is that there could be more surcharging across geos/retailers and it could impact consumer behavior (i.e. less Visa card payments)." While the Baird analysts generally back Visa's stock, they confessed in the report that "there is a lot of noise lately," noting the pandemic, buy now-pay later rivals, regulation, surcharging and debit issues.

Ultimately, they predicted the surcharging won't have much impact. "Surcharging has been allowed in many countries for years, and hasn’t really gained a ton of traction, so we aren’t sure that it will get much traction now either," the Sept. 2 report said. They hedged that outlook, though, saying it assumes that consumers stick with credit and debit cards.

Correction: The story was updated to correct Jeff Bezos' title. He is Amazon's executive chair.