Buy now, pay later company Affirm Holdings said last week that it won't charge interest on more of its long-term loans taken out from Oct. 22 through Oct. 24.

It's an unusual offer for a major player in the BNPL space, which just a few years ago promoted its signature pay-in-four product as an interest-free alternative to credit cards, but has increasingly embraced longer-term loans.

Today, about 15% of Affirm transactions are the short-term split payment transactions which are repaid over a few weeks that the industry is known for, a company spokesperson said in an email.

The spokesperson said the break on interest is being offered with the beginning of the holiday shopping season in mind.

About 71% of Affirm’s transactions are interest bearing, the spokesperson added, and 14% are 0% APR long-term monthly loans.

San Francisco-based Affirm began to lean more toward interest-bearing loans when it started working with major online retailers like Amazon, which the company first partnered with in 2021, said William Blair analyst Andrew Jeffrey.

While buy now, pay later companies undoubtedly compete with one another, Affirm and its peers also compete with rewards credit cards for high-income customers, Jeffrey said.

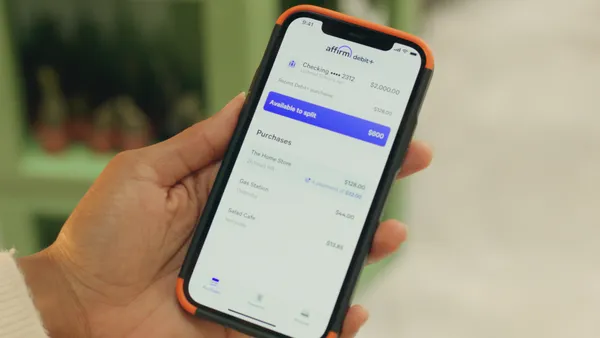

"Those 0% APR customers are higher quality and more likely to use other products like the Affirm [debit] card," he contended.

The buy now, pay later company’s competitors include the Swedish company Klarna and Afterpay, which is owned by Oakland-based payments company Block. Both of those companies also offer longer-term loans that accrue interest.

The upcoming interest-free promotion is also undoubtedly an effort to demonstrate the value proposition of BNPL compared to credit cards that offer cash back, Jeffrey added.

"At some point, the ability to pay off a $1,500 iPad [without interest] is more attractive than the 2% you get back on a rewards card," he said.

The promotion is available to eligible customers who shop at certain retailers with the Affirm app and the Affirm card, the company said in an Oct. 9 news release.

The company charges annual interest rates between 0 and 36%, the spokesperson said, although she declined to say what the average interest rate is on an Affirm loan.

Monthly installment loans that accrue interest are “far and away our biggest loan product, and also our most profitable,” Affirm CFO Rob O’Hare said in a fireside chat in September.

The offer is another sign that buy now, pay later is going mainstream, Jeffrey said.