Dive Brief:

-

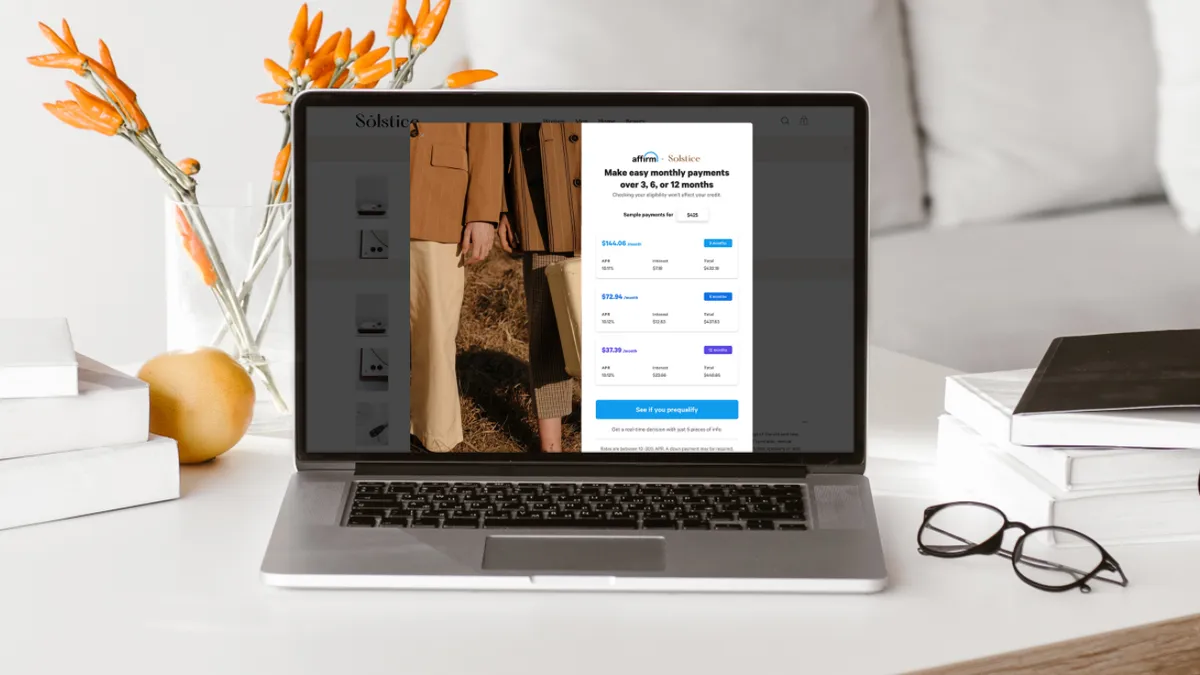

Affirm, the buy now, pay later (BNPL) payment provider has acquired Returnly, a returns payment platform, for about $300 million, the installment payment company announced on Wednesday. The two companies are expected to close the deal by the end of June.

-

Affirm, an early investor in Returnly, is acquiring the company to give consumers instant merchant credit upon initiating a return. U.S. consumers' merchandise return rates have risen, especially for online orders. The National Retail Federation (NRF) estimates customers returned $428 billion worth of merchandise last year.

-

Returnly currently serves more than 1,800 businesses and has processed more than $1 billion in returns. More than 8 million customers have used the platform, per the announcement.

Dive Insight:

Returnly introduced a returnless refunds feature in 2019 and debuted instant exchanges via Shopify Plus. The company aims to expand its reach with Affirm, Returnly CEO and Founder Eduardo Vilar said in a statement.

The Affirm acquisition follows Returnly raising $27 million in 2019 ($8 million in Series A funding and $19 million in a Series B) with Affirm participating as an investor.

According to the NRF research, online returns doubled from 2019 to 2020 and are a significant catalyst of return growth. In addition to causing financial challenges for retailers, companies also have to deal with the environmental impact of returning items that — due to the complex logistics of evaluating returned goods — largely don't wind up back on shelves for sale.

"We started Returnly to fix the broken returns model that offered consumers and merchants nothing but downside and frustration," Vilar said in a statement.

Affirm, a buy now pay later operator, does not currently offer merchants a solution for returns. The acquisition of Returnly, which is expected to close by June, will allow Affirm users to easily return products purchased on the buy now, pay later financing.

"Online shopping has accelerated over the last year," an Affirm spokesperson said. "With that, there's an effect on returns as they have more than tripled the rate of returns within physical retail."

Last year, Affirm added Shopify and David's Bridal to its roster of partners, as the company has steadily expanded its customer base.

Affirm raised $1.2 billion in its IPO earlier this year, with an initial price of $49 per share, higher than the anticipated range of $41 to $44 per share.

"In 2019, Affirm invested in Returnly because we recognized their technology's ability to help merchants remove friction from returns, drive loyalty, and retain more customers," Max Levchin, CEO and founder of Affirm, said in a statement. "Store credit, issued before the item is actually returned, is now a practical requirement in highly competitive segments like fashion and lifestyle."

This is Affirm's second acquisition in its current fiscal year, which ends on June 30. In December 2020, Affirm acquired the Canadian buy now, pay later company PayBright for CA$340 million [US$271.8 million].

"We always look at strategic opportunities that will build out and strengthen our network and capabilities in a way that aligns with our mission and values, where and when it makes sense," the Affirm spokeperson said.