Buy now-pay later providers Affirm and Klarna said they met a March 1 deadline to respond to Consumer Financial Protection Bureau (CFPB) questions about their business practices, making them the only two out of five companies to publicly acknowledge they expected to fulfill their obligations.

The federal agency made the request for detailed information from five big buy now-pay later (BNPL) providers in December because of concern over consumers taking on too much debt as the installment payment tool grows in popularity. The digital payment option, which is mainly used online, is particularly popular with young consumers.

San Francisco-based Affirm handed in its paperwork to the CFPB on time, according to Matt Gross, a company spokesman. Affirm says 168,000 merchants and 11 million consumers use its services.

Affirm CEO Max Levchin, who founded the company in 2012 and was also a co-founder of online payments pioneer PayPal, recently insisted he welcomed increased scrutiny because his company had nothing to hide.

"We've been at the forefront of the industry, suggesting to the regulators that they should have a look and a set of clear rules," and guidance for the conduct of companies in the industry, Levchin said during a February call to discuss the company's fiscal second quarter results. "And so, in that sense, it's positive news. The regulatory relationship is both a very, very important thing [and] a very serious thing."

Sweden-based Klarna planned to hand in its response to the CFPB "in full" on Tuesday, according to Michelle Kravets, a company spokeswoman. She declined to divulge the contents of the filing, saying it contained confidential information.

Klarna, founded 15 years ago in Stockholm, employs 5,000 and says it has 147 million active users worldwide that are shopping at some 400,000 merchants in 45 countries.

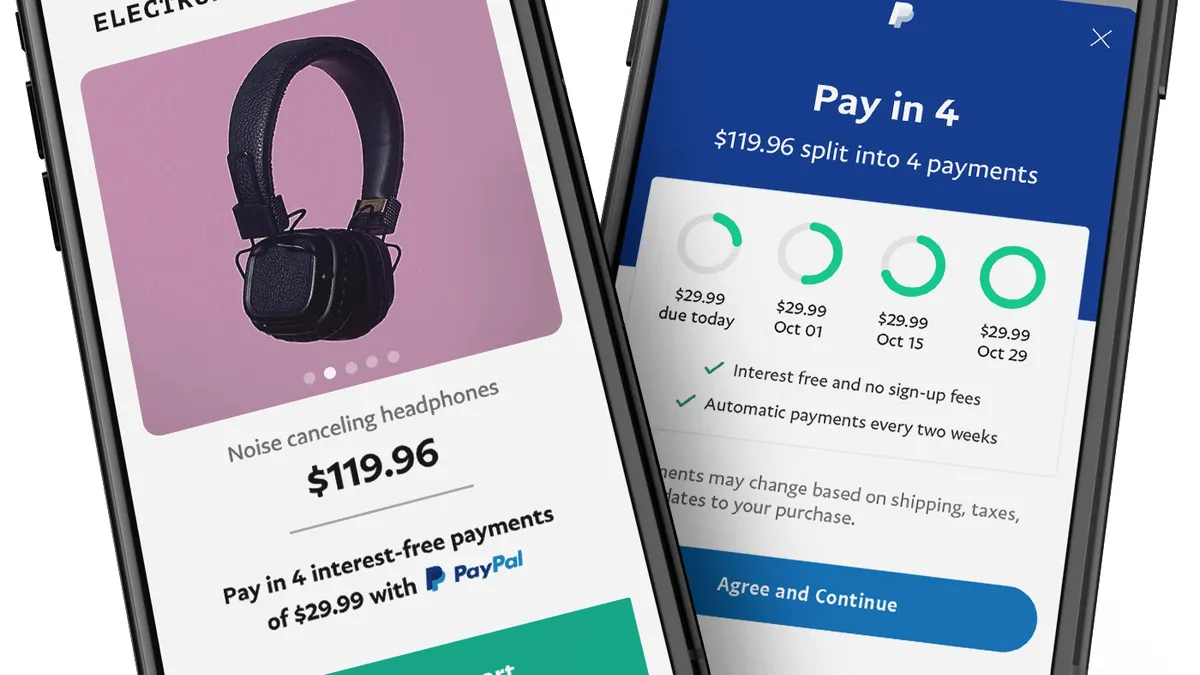

The CFPB also issued the Dec. 16 order requesting information to Block's Afterpay, PayPal and Zip, requiring all to provide information on a range of issues, including how much debt BNPL users have racked up and details on whether operators have followed consumer protection laws.

The agency also sought information on the companies' data harvesting from consumers. Some of the BNPL providers have created shopping apps with partner merchants.

The CFPB "sent out clarifications to questions on Feb 9th," according to an email from Kravets. She referred questions on the issue to the agency, which declined to discuss the topic.

Washington, D.C. attorney Allen Denson, who represents fintech companies and payments processors, pointed out that when the CFPB makes information requests, they usually come with a disclaimer that the information won’t be used for enforcement purposes. The agency’s probe of the BNPL industry doesn’t contain any such disclaimer, he said.

"I think we will see investigations opened up as a result of the information collection, and possibly enforcement actions," Denson said in an interview.

There’s plenty at stake in the CFPB’s proceedings. Consumers used BNPL services to make almost $100 billion in retail purchases in 2021, which was four times the level in 2020, Forbes reported, citing consulting firm Cornerstone Advisors.

Afterpay, which Block acquired for $29 billion, declined to discuss the CFPB's deadline, according to Amanda Pires, a spokesperson for the Australia-based business. Zip, an Australian company that has grown in the U.S. through acquisitions, also declined to comment on regulatory matters, a spokesperson said.

Zip said this week it planned to acquire U.S.-based Sezzle for $352 million as it seeks to expand its foothold in the world's largest economy. In 2020, the Sydney-based player acquired the U.S. BNPL company QuadPay for nearly $300 million.

Joseph Gallo, a spokesperson for PayPal, did not return phone calls seeking comment.

The CFPB inquiry isn't the only scrutiny BNPL providers have faced in recent months. A day before CFPB Director Rohit Chopra announced his investigation, six Democratic senators wrote him a letter urging the CFPB to review the BNPL sector because of its potential to cause harm to consumers.

They also claimed the BNPL providers operate without any meaningful federal oversight, a notion BNPL companies have disputed. Consumer activists, such as the Center for Responsible Lending, have raised similar concerns.