Dive Brief:

- Buy now, pay later provider Affirm has added two new payment plans, one that allows consumers to pay for a purchase in two equal installments in a 30-day period and another that lets them pay the full amount within the same time frame

- The two new financing options are part of a bid by the BNPL provider to take on credit cards for consumers’ daily purchases, Affirm spokesperson Matt Gross said in a Wednesday interview. The payment plans are now available in the U.S. for purchases made on Affirm’s mobile app, he said.

- “Adding options like Pay in 2 and Pay in 30 allows us to better meet consumers’ individual preferences, enabling them to pay for purchases large or small with more options that work best for their budgets,” Affirm Head of Product Vishal Kapoor said in a Thursday press release.

Dive Insight:

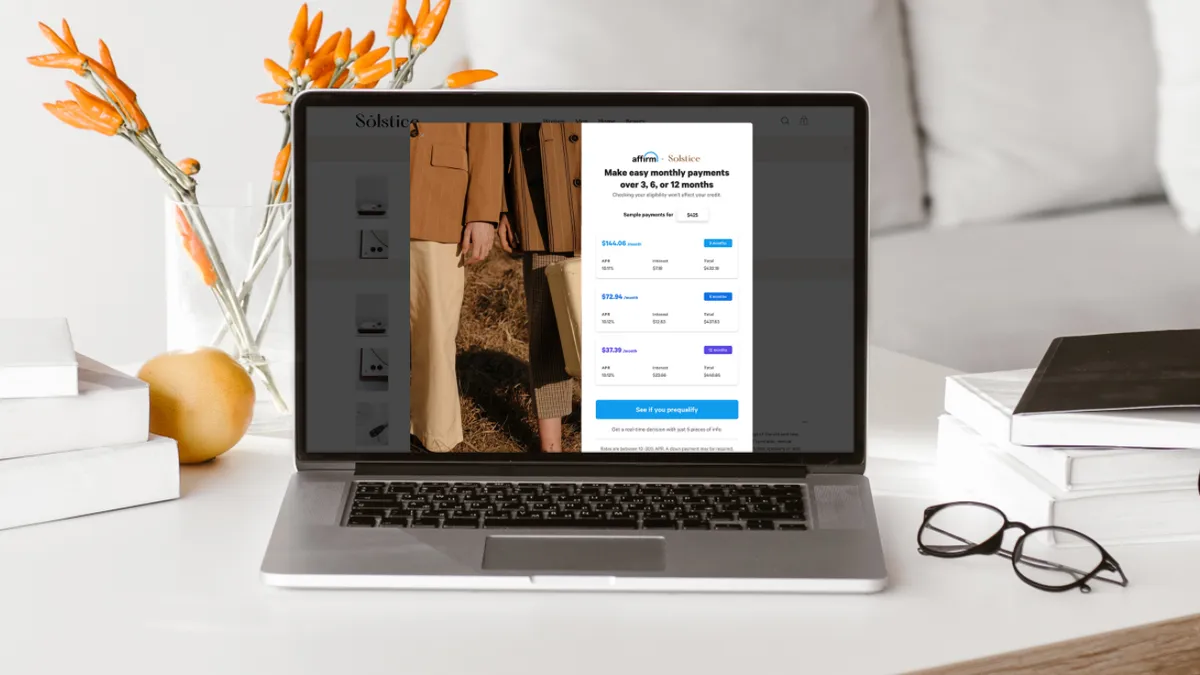

San Francisco, California-based Affirm previously offered its customers the ability to split purchases into four equal installments, or through monthly payments. The BNPL provider does not charge interest on its “pay-in-four” payment plans, however it may charge interest on the monthly installment plan.

Not every payment plan will necessarily be available for each transaction, Gross explained. Rather, the BNPL provider will determine which options to present based on the cost of the purchase, as well as a real-time underwriting decision, he said.

Affirm’s expansion into everyday purchases falls in line with comments made by CFO Michael Linford in March. Consumers had used the BNPL provider in less frequent purchases, including exercise bikes or mattresses, Linford noted during a presentation at the Morgan Stanley Technology, Media and Telecom Conference. But Affirm also wants its customers to tap it for daily transactions, such as coffee purchases, he said.

Consumers, particularly those under 35, have been increasingly using BNPL financing to pay for essentials such as groceries, according to a March report by NBC News. Rising prices and high credit card interest rates have nudged consumers toward the flexible payment option, the report said.

But the option may not be the cure consumers hope for. Fifty-six percent of people who used BNPL encountered at least one problem, including overspending and missing a payment, according to a March survey by marketing research firms Bankrate and YouGov.

The BNPL provider is facing its own financial pressures: it cut about 140 jobs, or about 6% of its workforce in February. It also posted a net loss of $133.9 million in its fiscal third quarter ended March 31. Its revenue for that period was $576.2 million, a 51% increase from the year-ago quarter.

Affirm is currently available to consumers in the U.S. and Canada, with plans to expand to the U.K. by the end of the year.