Monica Eaton is the CEO of the Chargebacks911, a Clearwater, Florida-based company that provides services for merchants in handling customer chargeback payments and fraud.

So-called “negative option” services are a controversial, yet time-tested method of doing business. Under this model, a customer signs up for a subscription service, typically as part of a free trial offer. The customer is then charged on an ongoing basis unless they explicitly cancel the service in question.

The folks at the Federal Trade Commission have carefully regulated these services for decades. Legacy FTC rules require sellers to disclose sale terms before consumers subscribe and to provide cancellation information. However, there’s a general impression that these requirements don’t go far enough. In response, the FTC recently proposed a “click-to-cancel” amendment to the existing Negative Option Ruleset.

As per a fact sheet recently published by the FTC, the proposed rule change takes things a step further by mandating the subscription cancellation process be as simple as the sign-up process. Businesses must now focus on improving their subscription cancellation process and investing in self-service tools for reactivating subscriptions and managing automated billing.

As FTC Chair Lina Khan explains, “The new rule aims to prevent businesses from tricking consumers into unwanted subscriptions, saving consumers time and money. Companies caught exploiting subscription practices would face severe penalties.”

This proposal reflects the growing consumer demand for an easier subscription cancellation process. However, this isn’t only in the interests of consumers; simplifying the cancellation process and making it more “customer friendly” is in the interests of merchants as well.

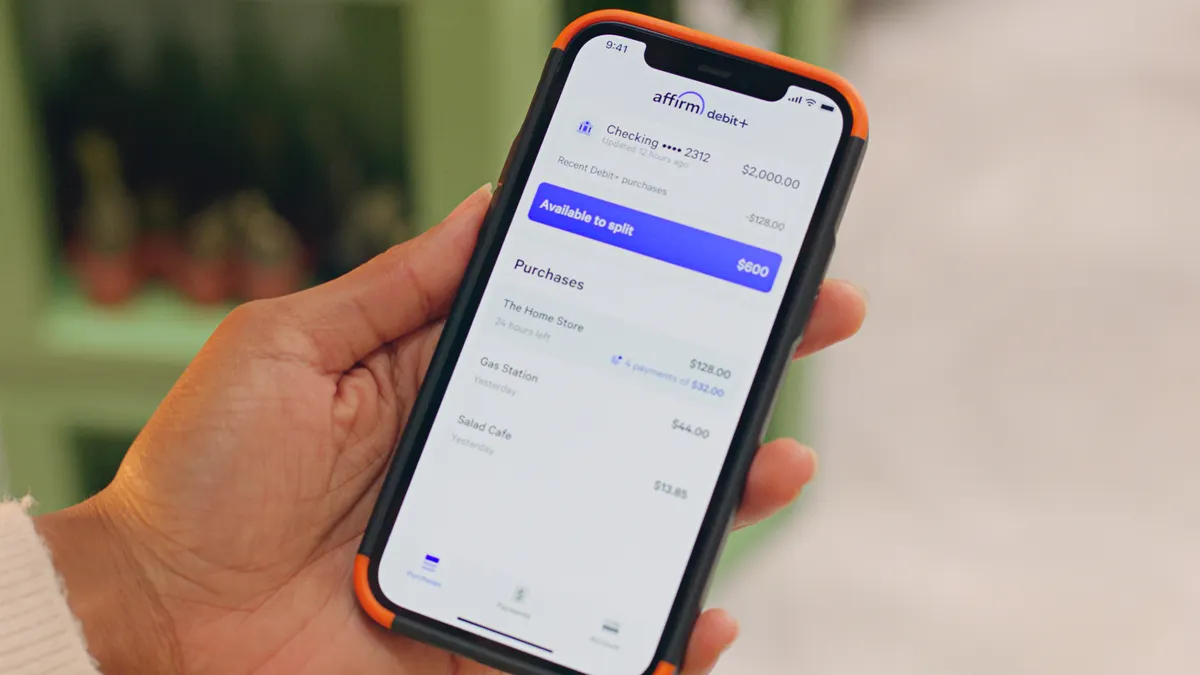

Innovative technology has transformed consumer behavior and expectations, necessitating secure, fast, and transparent digital experiences. To remain competitive, retailers must offer comprehensive self-service experiences, including flexible payment scheduling and frictionless convenience.

If retailers fail to meet these demands, they risk losing customers to brands that provide efficient, concierge-like services. This information gap between customers and retailers also creates opportunities for first-party misuse of the dispute process

Subscription retailers often face first-party misuse (sometimes called “friendly fraud”), which Visa reports as representing 75% of digital eCommerce chargebacks. This happens when consumers bypass the merchant and contact their bank to cancel a subscription, resulting in a chargeback against the retailer.

This is a growing—and very costly—problem for subscription retailers. According to the LexisNexis True Cost of Fraud Report, every $1 in fraud claims will ultimately cost the merchant around $3.75. Each dispute also leaves a negative, indelible mark on the merchant’s record.

Despite the industry's call for more feedback and education on chargebacks, the cancellation process remains a complex and resource-intensive for merchants. However, simplifying this process for customers can alleviate this problem. Clearly stating terms and conditions for recurring billing has long been recommended, regardless of whether the FTC adopts the proposed rule change.

The proposed click-to-cancel amendment to the Negative Option Rule is a significant step toward a more consumer-friendly subscription experience. By simplifying the cancellation process, the FTC is addressing the growing consumer demand for easier and more transparent subscription management.

Moreover, the proposed rule change may help prevent instances of first-party chargeback misuse, which plague subscription-based businesses. This will encourage retailers to be more proactive in providing comprehensive self-service tools that cater to the changing needs of consumers.

But, while the proposed amendment is a positive development, it is essential to acknowledge that these changes won’t address every issue. To get well ahead of the issue and remain relevant, businesses must adopt a proactive approach toward customer-centric account management practices. They need to focus on transparent billing processes, and provide self-service tools that cater to evolving consumer expectations.

Companies should also incorporate recurring billing information and terms and conditions into the checkout process. They should send frequent reminders and billing confirmations before each rebill, as well as before renewal dates. This will help prevent “surprise” charges that may precipitate chargebacks.

Even if the retailer complies with all payment processing guidelines, a cumbersome cancellation process may lead to customers filing chargebacks or complaints with the FTC or Better Business Bureau. To navigate this landscape, businesses must strike a balance between protecting themselves and ensuring customer satisfaction.

The road ahead involves not only implementing the proposed click-to-cancel amendment, but also adopting additional measures to provide an optimal customer experience. For instance, retailers should consider investing in technologies that facilitate seamless communication, transparent billing and easy subscription management.

Further, it’s crucial for businesses to educate consumers about fraud, chargebacks and the potential consequences associated with them. Proper communication channels and ongoing dialogue with customers can help minimize the risk of disputes. Ultimately, this will help ensure a healthy, long-term relationship between retailers and consumers.