Dive Brief:

-

This year's agenda for the Electronic Transactions Association (ETA) is focused on contributing to federal efforts to deliver stimulus money to Americans and small businesses seeking to recover from the COVID-19 pandemic, ETA CEO Jodie Kelley said in an interview. The organization estimates it has helped the U.S. Treasury to distribute $9 billion to 57 million Americans through prepaid debit cards.

-

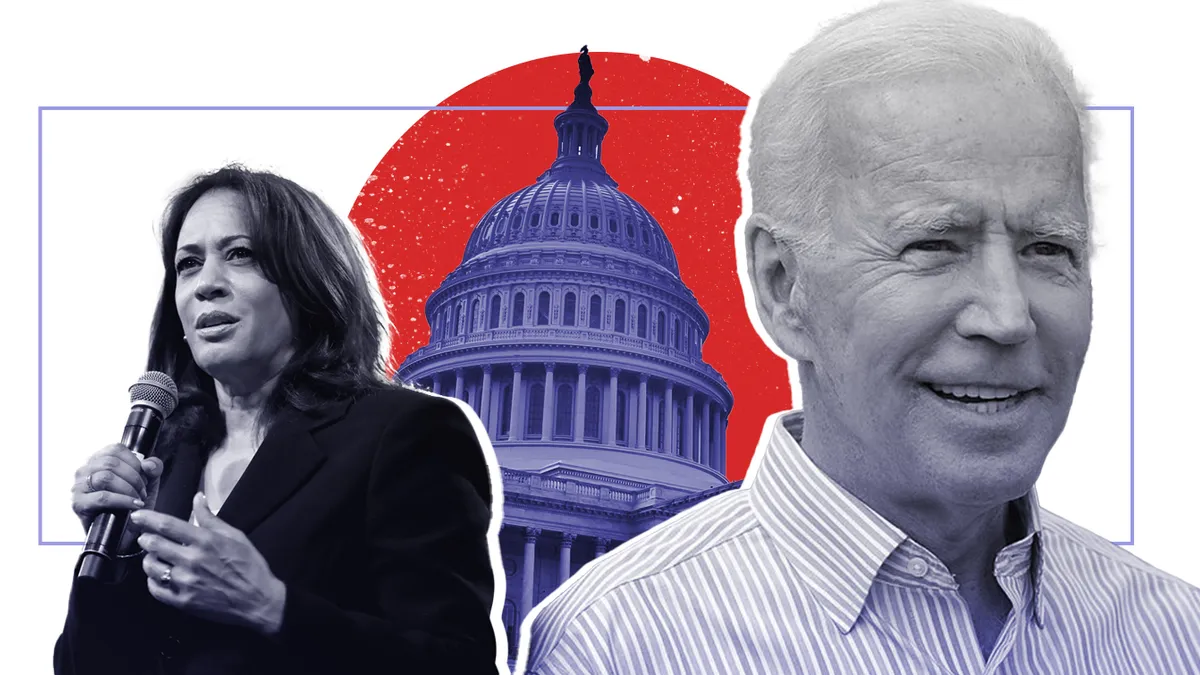

Last year, the ETA worked with lawmakers on privacy issues, but has shifted its attention to the Biden administration's goals, namely the economic stimulus programs and infrastructure development goals, she said. "There is a generally positive and hopeful sense" about the Biden administration, she said, noting the new presidency is only 60 days old. The industry's desire is "to lean in and be helpful and productive."

- One issue the ETA is not involved in is the Washington fracas over debit and credit card fees touched off by Visa and Mastercard's now-canceled plans to increase interchange 'swipe' fees. Senate Majority Whip Dick Durbin drew attention to the issue this month by castigating the credit card companies for contemplating fee increases, calling the pair a "duopoly" at a congressional hearing on antitrust issues this month. Shortly thereafter, Visa disclosed that the Department of Justice (DOJ) was investigating its debit card business.

Dive Insight:

The ETA includes some 500 corporate and organization members, from credit card companies such as Visa and Mastercard, to big technology companies like Amazon and Paypal, to fintech upstarts such as Stripe and Marqeta. Those members process about $21 trillion in transactions annually through various payments systems. Like other trade groups, it advocates on behalf of the industry on the federal and state levels, provides networking opportunities for members, and keeps its members apprised of industry trends, information and practices.

ETA lent its support and assistance to the U.S. stimulus programs delivering money to individuals, and the Paycheck Protection Program (PPP) payouts directed at businesses, Kelley said. ETA informed the federal government of the ways in which its members could help distribute payments quickly, she said. Those efforts continue on the state level too, with ETA members helping facilitate unemployment benefits with prepaid debit cards too, she said.

While some ETA members might be expected to have competitive differences or be at odds in some policy debates, Kelley said that's not as often the case today. A rising number of corporate ties between industry players working together to advance in a fast-changing technology environment is part of the explanation. "There is not as much friction as you might imagine because there is a lot of partnering going on as everybody races to keep up," she said.

Looking ahead, she said the ETA is keeping a close eye on the central bank digital currency debate. "There's a lot of interest in it," Kelley said.

Federal Reserve Chairman Jerome Powell said this month that he's in no rush to issue such a currency. Still, Treasury Secretary Janet Yellen has noted how it could be helpful in providing financial services to underbanked people. Generally, the ETA is also watching what increased involvement the federal government might have in payments and financial services more broadly, Kelley said.