The Latest

-

CFPB nixes filing in case tied to Electronic Funds Transfer Act

The bureau’s brief was withdrawn because it “advances an interpretation of the law that has never been embraced by any federal court prior.”

-

Utah governor signs EWA law

The state joins a pack of others that have passed industry-friendly laws seeking to oversee earned wage access providers and their services.

-

Block shrinks workforce 8%

The job cuts appear aimed at making the company more efficient, according to TD Cowen analysts.

-

CFPB predicts late fee lawsuit settlement

The agency’s new leadership believes it can settle a 2024 lawsuit banks and business groups filed over an $8 cap on credit card late fees.

-

Republicans air CFPB grievances, jockey for agency change

Kentucky Republican Rep. Andy Barr called the bureau an “Orwellian predator” at a House subcommittee hearing where several lawmakers proposed reforms.

-

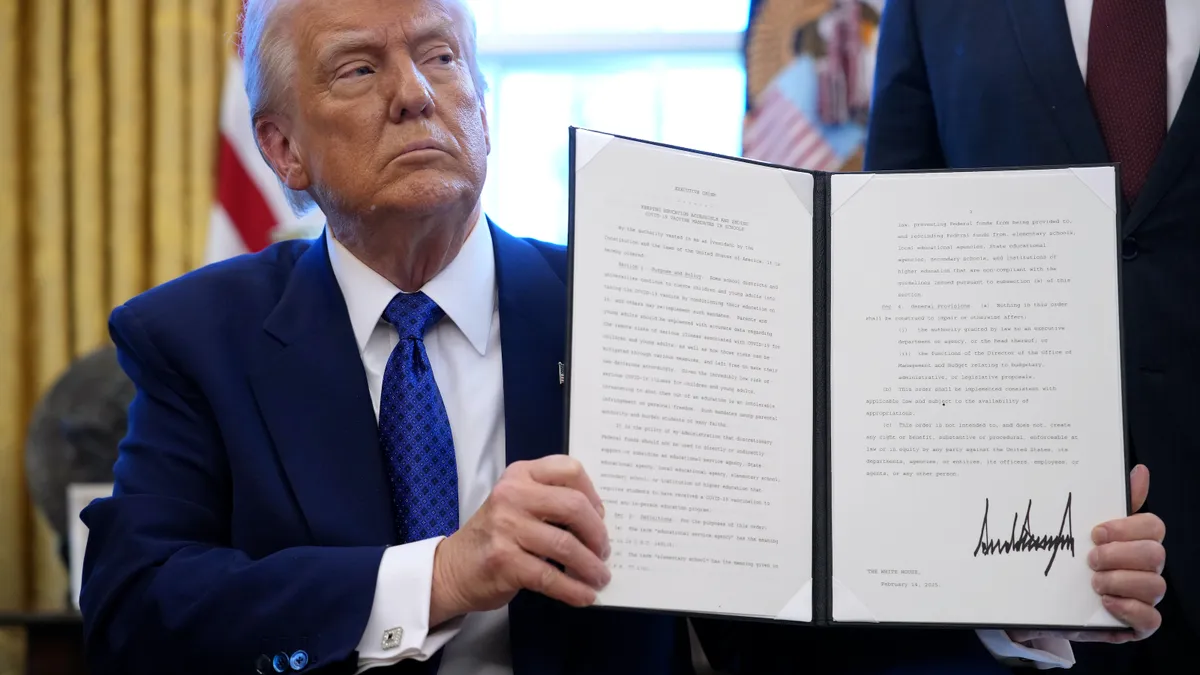

Trump calls on federal gov’t to banish paper checks

The White House issued an executive order Tuesday calling on the federal government to cease using paper checks by September, except in certain circumstances.

-

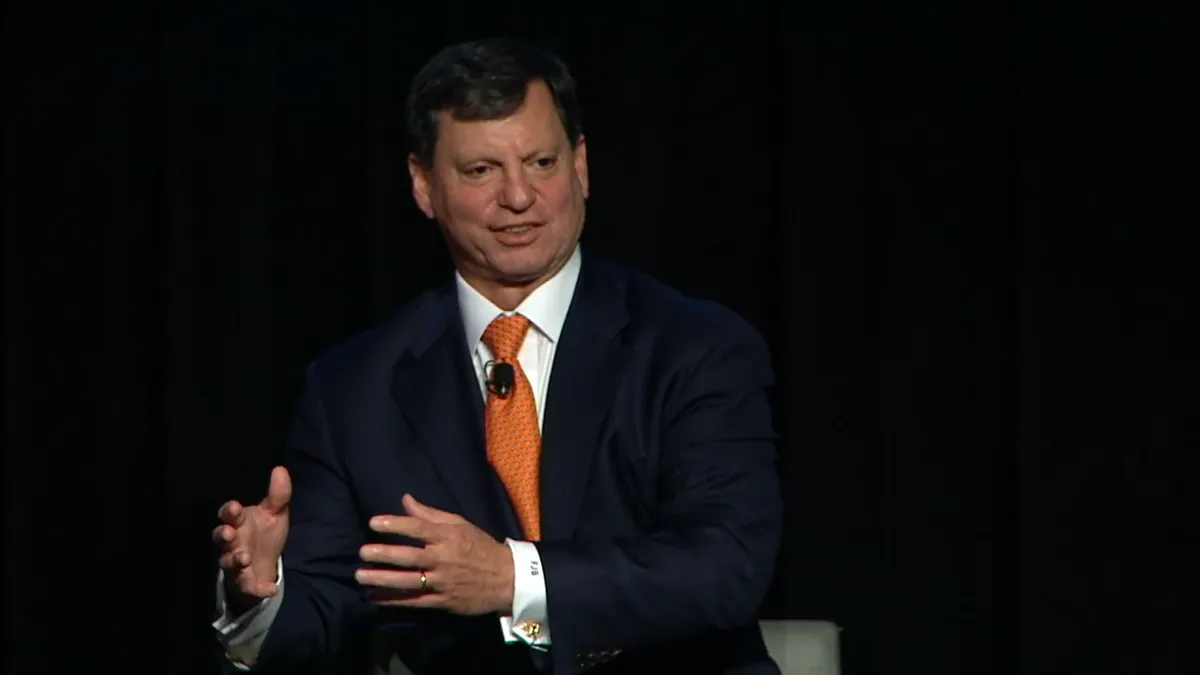

Fiserv CEO vows to keep Social Security Administration intact

Senate Democrats questioned Frank Bisignano on privatization of the federal agency’s function during a confirmation hearing Tuesday.

-

Revolut US CFO aims for growth, maturity ahead of U.S. entry

Balancing agility and compliance is crucial for the digital banking platform as it seeks to expand into markets like the U.S., Revolut Chief Financial Officer Max Lapin said.

-

Caitlin Mullen/Payments Dive, data from Fiserv

Caitlin Mullen/Payments Dive, data from Fiserv

Fiserv CEO faces fire for Social Security cuts

Two Senate Democrats are calling on Frank Bisignano to oppose any cuts to Social Security ahead of hearings on his nomination to lead the agency.

-

Banks bash Illinois trend-setting law on card swipe fees

Banks and credit unions are trying to kill a new Illinois law banning interchange fees, with a court filing, as multiple states seek to emulate the legislation.

-

Q&A

Fintechs egg on ‘willingness to challenge norms,’ Bolt president says

Justin Grooms expects fintechs to keep pushing the payments industry forward with more competition for legacy players.

-

Arkansas, Utah move ahead with EWA laws

The two states are the latest to pass legislation addressing workers’ growing practice of using earned wage access to tap their income before a regularly scheduled payday.

-

CFPB seeks extension to respond to nonbank oversight lawsuit

The Consumer Financial Protection Bureau asked a federal court for more time to respond to a lawsuit over its authority to oversee big tech payments players.

-

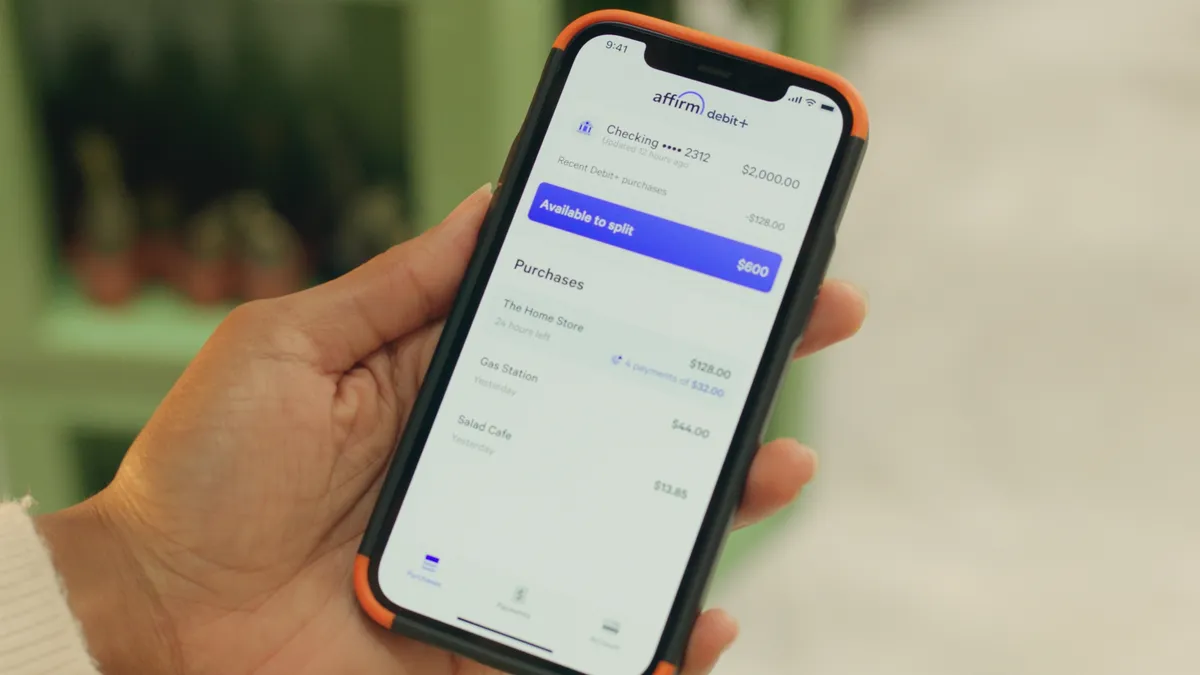

Affirm, other BNPL players ratchet up credit bureau reporting

At least three buy now, pay later firms have begun reporting consumer data on installment financing to TransUnion or Experian, and another gives customers the option of reporting that data.

-

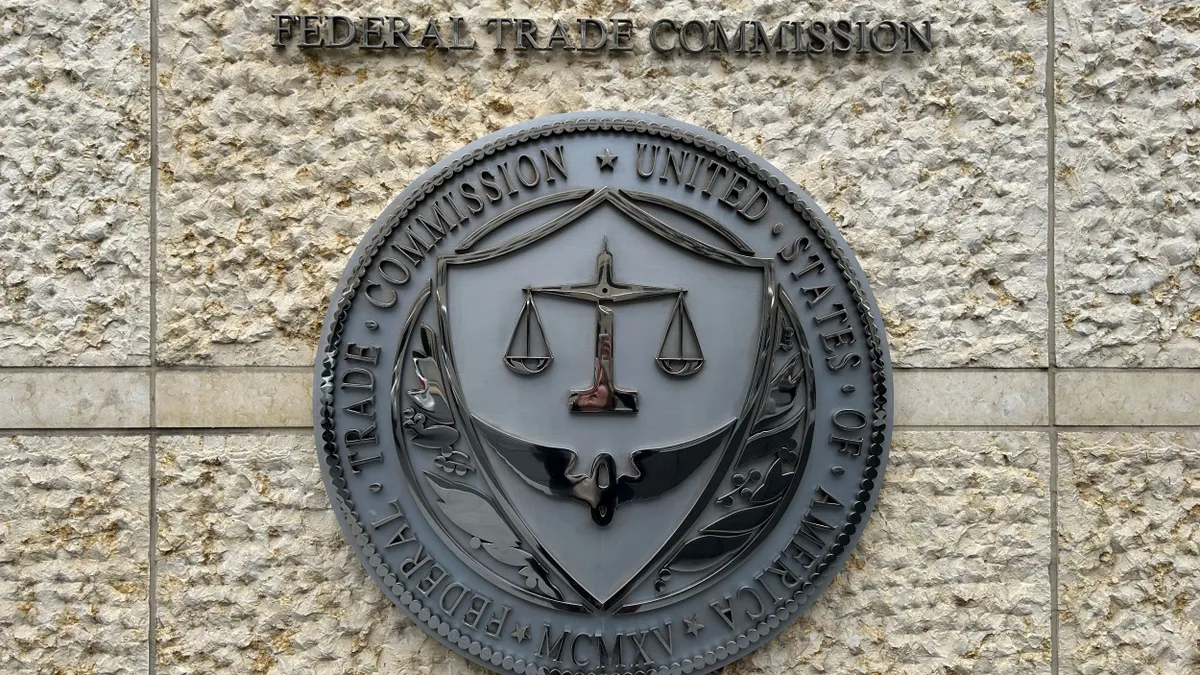

Bank transfer fraud losses outpace crypto

The value of fraud losses last year was highest for bank transfers and payments, followed by cryptocurrency transactions, according to a report from the Federal Trade Commission released last week.

-

Retailers push payment modernization

A KPMG survey found that a majority of retailers plan to keep updating their payment programs to keep up with consumer tech demands.

-

Mastercard courts community banks

The card network has initiated a new partnership with the Independent Community Bankers of America that will extend its services to that group’s financial institution members.

-

Payments players landed less capital in 2024: S&P report

Venture capitalists invested 47% fewer dollars, compared to 2023, despite most of the startups posting increased revenue last year.

-

Discover cards now accepted at Airwallex merchants

A partnership gives the card network a wider reach at a time when its proposed merger with Capital One still awaits regulatory approvals.

-

Fiserv acquires Dutch payment company CCV

The processor will use CCV to expand the presence of its Clover point-of-sale system across Europe, the company said. The price paid was about $220 million, according to a regulatory disclosure.

-

Corpay CAO steps up as CFO exits for nonprofit

Alissa Vickery is taking over as interim CFO as Tom Panther has left the company to become CFO of the National Christian Foundation.

-

Klarna seeks to flex advertising muscle

Buy now, pay later provider Klarna has become an advertising juggernaut, and the new tie to Walmart will give it access to troves of additional customer data.

-

Fiserv, PayPal and FIS change up board members

Payments companies are adding board members, and bidding farewell to others, as the industry sees increased merger and acquisition activity.

-

Affirm executive joins crypto firm Gemini as CFO

Dan Chen was formerly the vice president of capital markets and bank partnerships for the buy now, pay later company.

-

Trump Organization lawsuit raises questions about Capital One-Discover deal

Capital One needs three U.S. approvals to proceed with its $35 billion purchase of Discover. Could a Trump Organization lawsuit against the bank spell trouble?