Regulations & Policy: Page 26

-

Visa raises concerns on new gun code

Visa cautioned the public about perceiving a new merchant code for gun-sellers as a means to interfere with any lawful sales. And the NRA said it’s seeking to water down implementation of the new code.

By Lynne Marek • Sept. 14, 2022 -

Zelle counters scam talk with growth rates

The instant payments brand is highlighting a double-digit growth rate for its peer-to-peer payments tool and downplaying scams on its system.

By Lynne Marek • Sept. 12, 2022 -

Explore the Trendline➔

Explore the Trendline➔

1401461124 via Getty Images

1401461124 via Getty Images Trendline

TrendlineTop 5 stories from Payments Dive

The digital evolution of payments is roiling the industry, forcing companies to rethink pricing schemes and revamp corporate strategies. Embedded payments, earned wage access, real-time systems and other innovations will transform the business.

By Payments Dive staff -

Visa to adopt new coding for gun merchants

Card network juggernaut Visa said it will adhere to a new standard for identifying independent gun shops with a unique merchant code after an international body adopted the new approach last week.

By Caitlin Mullen and Lynne Marek • Sept. 12, 2022 -

Gun merchant code approved for card purchases

An international standards body approved a new merchant code that will apply to gun sellers for transactions using credit card networks like Visa and Mastercard.

By Caitlin Mullen • Updated Sept. 9, 2022 -

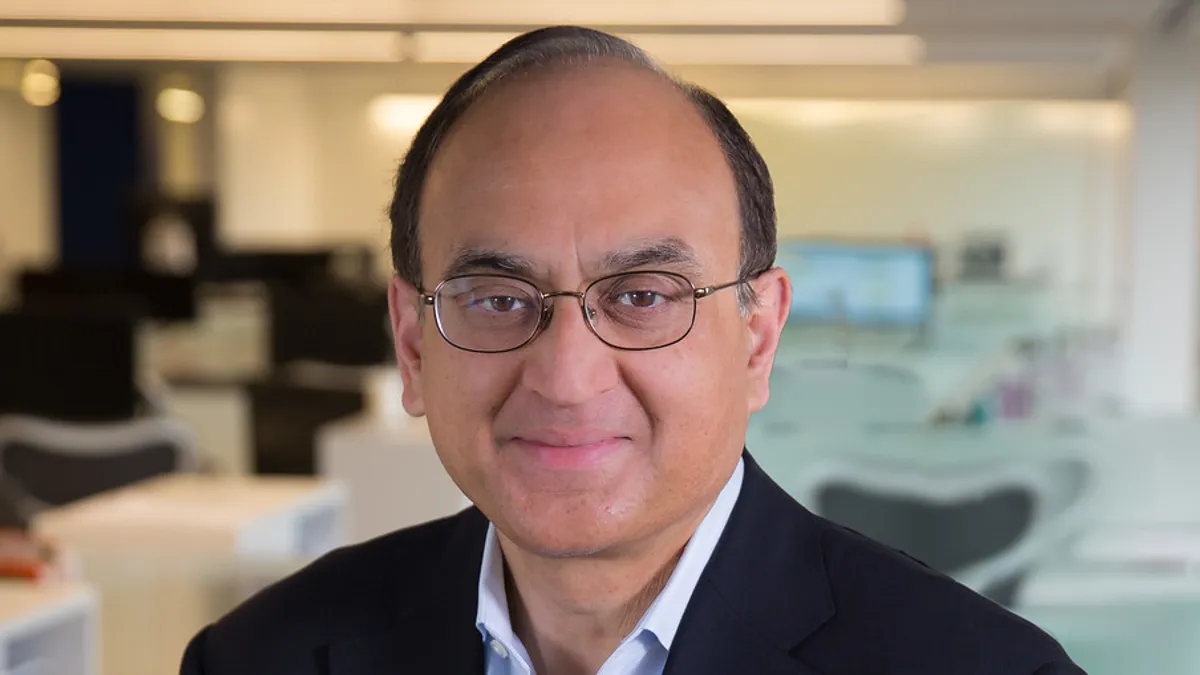

New Fed official speaks to payments, crypto and FedNow

Here are 10 takeaways from the Fed's new head of supervision, on everything from payments to crypto to FedNow.

By Dan Ennis • Sept. 8, 2022 -

Basic income pilots gain momentum across US cities

At least a dozen U.S. cities have implemented unconditional direct cash payment programs over the past year, as advocates seek to build evidence and experts debate the most effective structures.

By Gaby Galvin • Sept. 8, 2022 -

Healthcare fintechs targeted by cyber criminals

Cybersecurity professionals say healthcare payments processing firms are particularly vulnerable to information technology breaches and ransom demands.

By Joe Burns • Sept. 8, 2022 -

Visa, Mastercard face cross-border fee questions in U.K.

The U.S. card giants are taking a stand in defense of their services for cross-border transactions as U.K.’s parliament and regulators scrutinize higher fees.

By Lynne Marek • Sept. 7, 2022 -

Lawmakers push card companies to back gun-merchant code

Democratic Congress members, in letters to the CEOs of Visa, Mastercard and American Express, pressed the companies to support creating a merchant code for gun sellers.

By Caitlin Mullen • Sept. 7, 2022 -

Retrieved from Flickr/frankieleon.

Retrieved from Flickr/frankieleon. Opinion

OpinionConsumers need credit card reform

“It's not just merchants at the mercy of the oligopoly,” writes Ed Mierzwinski, a senior director at the Public Interest Research Group. “Consumers all pay more at the store and more at the pump.”

By Ed Mierzwinski • Sept. 2, 2022 -

Go slow on a CBDC, Nacha says

The biggest payment system in the U.S. recommends limited implementation of a central bank digital currency if the Federal Reserve pursues that digital dollar.

By Lynne Marek • Sept. 2, 2022 -

Who’s afraid of FedNow? Not Visa

Visa's CFO on Wednesday brushed off any concerns about the threat of new competition from FedNow, or any other real-time payments system.

By Lynne Marek • Sept. 1, 2022 -

Card companies urged to code gun sellers

Calls from government officials urging Visa, Mastercard and American Express to support creating a merchant code for gun sellers are growing louder.

By Caitlin Mullen • Aug. 31, 2022 -

Retrieved from Federal Reserve Bank of Boston.

Retrieved from Federal Reserve Bank of Boston.

FedNow aims for September testing

FedNow, an effort by the Federal Reserve Banks to speed up and modernize the U.S. payments system, is expected to launch as early as next May.

By Lynne Marek • Aug. 30, 2022 -

Banks push back against CBDC

The nation’s biggest bank and bank trade groups stressed the risks of creating a central bank digital currency in comments to the Fed, and largely rejected the idea that a digital dollar would accomplish stated goals.

By Lynne Marek • Aug. 29, 2022 -

Big payments companies poke at CBDC

Mastercard, PayPal, Fiserv and Stripe gave the Federal Reserve feedback on a central bank digital currency, pointing out key requirements and cautioning about the outcome.

By Lynne Marek • Aug. 25, 2022 -

Lawsuit filed against Block

A class action lawsuit has been filed against Cash App Investing and parent company Block over a December 2021 data breach.

By Caitlin Mullen • Aug. 25, 2022 -

The image by Ted Eytan is licensed under CC BY-SA 2.0

The image by Ted Eytan is licensed under CC BY-SA 2.0

CFPB seeks more credit card transparency

The Consumer Financial Protection Bureau is considering requiring top credit card issuers to share more information on their products to increase transparency for consumers.

By Caitlin Mullen • Aug. 24, 2022 -

DailyPay releases card with Visa

The earned wage access provider introduced the new debit card after major changes in leadership earlier this year.

By Tatiana Walk-Morris • Aug. 23, 2022 -

The image by Ted Eytan is licensed under CC BY-SA 2.0

The image by Ted Eytan is licensed under CC BY-SA 2.0

CFPB spotlights payments risks

The Consumer Financial Protection Bureau is “carefully monitoring” payments innovations and risks they pose to consumers, the agency said in a report.

By Caitlin Mullen • Aug. 22, 2022 -

FedNow to launch by mid-2023, Fed official says

The federal government’s new real-time payments system should be ready for use by the middle of next year, Fed Governor Michelle Bowman said in a speech this week.

By Lynne Marek • Aug. 19, 2022 -

Paysign aims to grow prepaid card services for drugs

Paysign aims to boost its prepaid card services for consumers shouldering the high cost of pharmaceuticals by offering drugmakers transparent pricing for such services.

By Joe Burns • Aug. 16, 2022 -

Column

Let the credit card battle begin

Banks that issue credit cards and the retailers who hate their fees are lining up allies on Capitol Hill to fight over a new bill that calls for more competition in the industry. Visa and Mastercard are at the center of the conflict.

By Lynne Marek • Aug. 8, 2022 -

Visa, Mastercard react to Pornhub ruling

The two card companies took action against an advertising entity tangled up in a California lawsuit against the pornography website, which the plaintiff alleges illicitly posted images of her when she was a teenager.

By Lynne Marek • Aug. 5, 2022 -

FIS extends tie with Chargebacks911 to fight fraud

The partnership is aimed at arming merchants with digital tools to reduce chargebacks, cut costs and combat fraud.

By Jonathan Berr • Aug. 5, 2022